Off market distressed properties present a unique opportunity for real estate investors to acquire undervalued assets. This article dives into various strategies for locating these hidden gems, why they matter, and how to leverage technology to streamline the process. Understanding these elements can significantly boost your investment success.

Understanding Off Market Distressed Properties

Off market distressed properties hold a unique allure for investors due to their potential for profitability and the chance to create value. These properties are not listed publicly, which makes them less known and harder to find, but this is exactly why they can hold such promise.

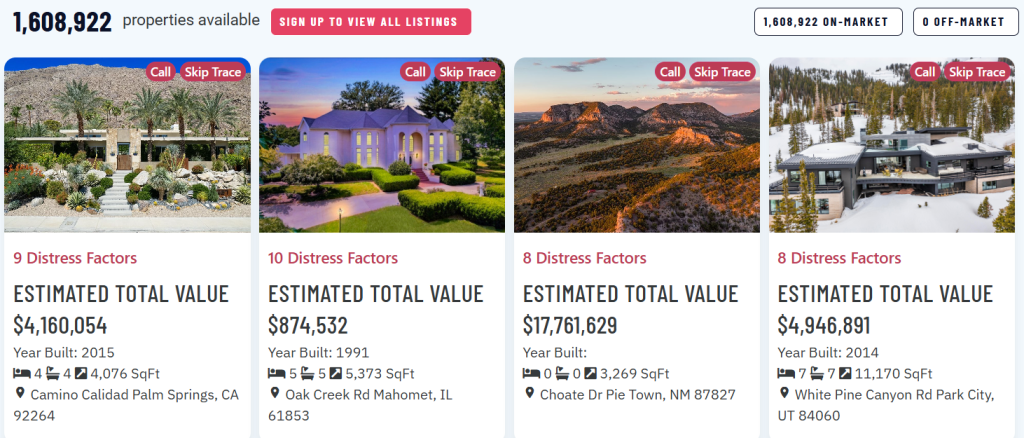

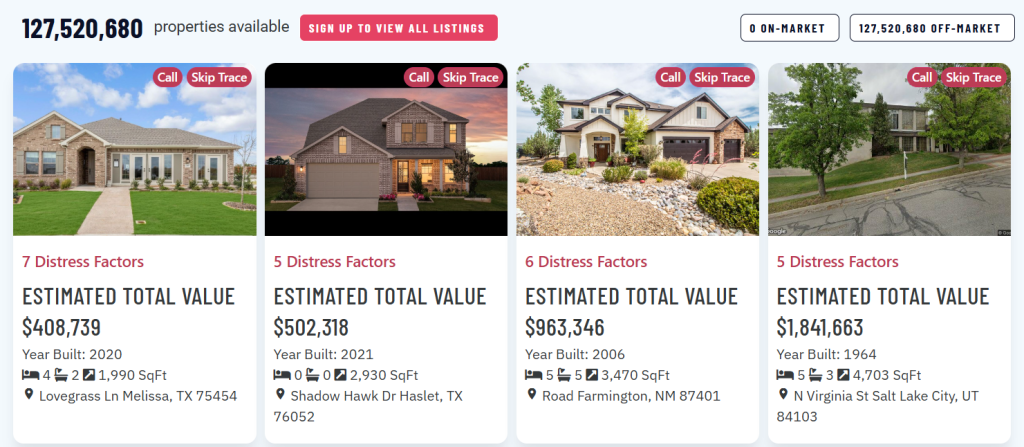

Understanding what defines a property as “distressed” is key. Distressed properties are often under financial pressure, perhaps due to foreclosure proceedings, inheritance issues, or neglect, which results in them being sold at lower prices. They may need repairs, but this also means there’s an opportunity to enhance their value significantly.

Investors are drawn to off market distressed properties because they’re often acquired below market value, allowing for higher profit margins when resold or rented. Additionally, avoiding traditional listings means there’s typically less competition, offering a significant edge for those willing to dive deeper into this market.

These properties come in various forms. They can be anything from a large, neglected home to a smaller commercial space that has seen better days, each bringing its own set of challenges and opportunities. Many distressed properties are homes, but they can also include abandoned commercial properties or foreclosed office spaces.

One compelling advantage of acquiring these properties is the sheer innovation the process invites. Investors must harness creativity, diligence, and a keen eye for potential, attributes that are invaluable for success in the realm of real estate. Moreover, acquiring these properties often requires innovative communication techniques, such as cold calling, to identify and negotiate with owners directly.

Understanding the intricate landscape of off market distressed properties is a fundamental step toward unlocking the potential they hold. This is a rich playground for those willing to explore beyond conventional methods, setting the stage for future strategies that tap into these hidden opportunities.

How to find off market properties near you

To find off market distressed properties near you, consider engaging in a strategy that combines people skills, technology, and a bit of detective work. First, networking can be a goldmine. Reach out to real estate professionals, contractors, and fellow investors. Attending industry events can open the door to hidden opportunities. These gatherings allow you to build relationships with people who might have inside info about distressed properties ready to sell.

Online social platforms offer another valuable avenue. Real estate forums such as Biggerpockets and local community groups sometimes share leads privately. Additionally, technology can enhance your searching process. Direct marketing, like cold calling or sending mailers, is effective too. For cold calling, a robust VOIP system with efficient dial infrastructure such as in BatchDialer is key. It allows you to reach multiple sellers systematically with multi-line dialing system. Tailor your messages to address pain points of potentially motivated sellers.

The role of tech in your strategy shouldn’t be underestimated. Data analytics can precisely target homes showing signs of distress. For instance, leverage resources on how to identify distressed properties. These signs might include overdue taxes or visible neglect. Technology doesn’t replace relationships but enhances them by providing concrete leads.

Reaching out to motivated sellers through personalized engagement is imperative. They’ll respond better if addressed with empathy and understanding. Address their needs and offer solutions that benefit both parties. Carefully targeted outreach like this increases your chances of discovering those hidden, off market gems.

Leveraging Technology for Efficient Lead Generation

Leveraging technology in real estate can be a game-changer. One such powerful tool is BatchLeads utilizes advanced property intelligence and AI capabilities. It helps real estate pros streamline their lead generation. Imagine skipping the guesswork and having the data you need right in front of you.

Batchleads capabilities include skip tracing, which is pivotal. It helps track down property owners who might be hard to find. With precise data, you can connect with the right people without wasting time With detailed reports and insights, you can make smarter decisions, targeting those hidden properties fewer know about. It’s like having a treasure map for distressed properties.

These tech advancements make finding off market distressed properties much easier. If you’re exploring new ways to enhance your real estate skills, consider diving deeper into how cold calling techniques can boost your outreach. Embrace the role of technology and watch how it transforms your approach from manual to magnificent.

Maximizing Your Investment Strategy with Off Market Deals

Maximizing your investment strategy in off market distressed properties takes a mix of creativity and caution. First, evaluating property effectively is crucial. Analyze location, market trends, and the property’s physical condition. Each factor plays a significant role in determining the property’s potential.

1. Evaluate the Property Thoroughly

Success starts with knowing what you’re getting into. Focus on three key elements:

- Location – Understand neighborhood trends, nearby developments, and demand.

- Market Conditions – Analyze recent sales and forecasted growth.

- Physical Condition – Assess repairs needed and potential rehab costs.

These factors directly impact your property’s profitability and resale potential.

2. Manage Risk Wisely

Off-market deals often come with added uncertainty. To reduce exposure:

- Conduct thorough inspections to uncover hidden issues early.

- Prepare for unexpected costs, including structural repairs or permitting delays.

- Maintain a financial buffer to handle surprises without derailing your strategy.

Being proactive about risk keeps your investment stable and profitable.

3. Negotiate Like a Pro

Negotiation is critical in distressed property deals—here’s how to do it right:

- Build rapport with sellers to uncover their true motivations.

- Be patient and flexible, adjusting your offer based on both the seller’s needs and your financial goals.

- Aim for a win-win outcome, where your deal makes sense on both sides.

Mastering this step can significantly improve your deal flow and margins.

4. Leverage Technology to Your Advantage

Tools like BatchLeads can supercharge your off-market investing strategy by helping you:

- Identify high-quality leads with detailed property and owner data.

- Manage outreach using built-in multi-channel tools like cold calling, texting, and direct mail.

- Track performance and refine your approach with advanced analytics.

Check out our guide: [4 Real Estate Cold Calling Scripts to Increase Leads] to maximize your outreach efforts.

Wrap Up

In summary, off market distressed properties offer a wealth of opportunities for investors willing to seek them out. By leveraging advanced tools, such as BatchLeads, you can efficiently identify and acquire these valuable properties, ultimately enhancing your investment portfolio. Take action now !