Finding distressed properties can open doors to significant investment gains. You’re here to learn how to find distressed property, and that’s precisely what this article delivers: no fluff, just straightforward, applicable knowledge for identifying and securing these real estate deals in this highly competitive market. This guide will delve into the nuances of distressed property investment, offering insights and strategies that cater to both the novice and the seasoned investor.

Understanding Distressed Properties

Defined as properties burdened with financial or physical woes, foreclosure or repossession. Distressed properties are the diamonds in the rough of the real estate world. Yet, for the savvy real estate investors, these properties are ripe with opportunity, promising lucrative returns and the chance to build a robust investment portfolio.

Effectively harnessing these prospects requires a comprehensive understanding of distressed property types and the delicate interplay between their potential benefits and challenges.

Types of Distressed Properties

Among the vast terrain of the real estate market, three types of distressed properties emerge as particularly noteworthy for their potential and challenges:

Foreclosures

Real estate owned, or foreclosed property comes under foreclosure when the homeowner couldn’t keep up with their mortgage payments for a while and then the lender steps in to officially declare a notice of default and considering the numbers, a foreclosed property is a very common distress factor out there.

Short Sale

In a short sale, the property remains in the original owner’s hands rather than being repossessed by the lender. In this arrangement, the lender agrees to let the property be sold for less than the outstanding mortgage balance. While foreclosure looms as a potential outcome, a short sale provides a chance to avoid the detrimental impact on the owner’s credit history. The property is in a state of financial distress, yet it’s at an earlier stage where intervention is still possible.

Abandoned or Neglected Properties

When the owner prioritizes other life aspects than maintaining his/her property, it’s state of disrepair becomes apparent even from a casual glance down the street. In some cases, these individuals may fall behind on mortgage or property tax payments, leading to a potential foreclosure or tax lien. However, not all property owners follow this path some may own their properties outright without the burden of a mortgage.

Each distress factors beckons with its own set of circumstances, offering different pathways for real estate investors to explore and capitalize on.

Key Indicators of Distressed Properties

Finding distressed properties is a detection game, rewarding investors with a keen eye for details. Signs that herald these properties’ existence are scattered across the physical realm, life events, and financial landscapes. The ability to identify these signs often determines whether an investment opportunity is missed or seized profitably.

Physical Signs

When searching the neighborhood streets using Driving for Dollars method , one can find overgrown lawns, broken windows, or peeling paint, each a silent herald of a potentially distressed property. These physical cues, such as an unkempt yard, suggest extended neglect, hinting at an absentee homeowner who might be receptive to selling.

Similarly, boarded-up windows are often synonymous with neglect and financial difficulty, while a deteriorating exterior could imply a property’s distressed status, ripe for the taking.

>> Quickly learn how use find distressed properties using Batchleads Driving For Dollars <<

Life Event Indicators

Life events can unexpectedly thrust properties into the distressed category. Estate sales following a death, or property settlements from divorces, often become available for purchase and can be identified through obituaries or county foreclosure listings. Attorneys handling such sensitive cases may have insider knowledge about these properties.

When approaching these situations, tread with respect and empathy, as these events are personal and often fraught with emotion.

Financial Red Flags

Financial distress also serves as a beacon to the discerning investor. A property with a history of delinquent mortgage payments or tax liens is a strong indicator of distress. These signs can be unearthed in public records or through the local tax assessor’s website, revealing properties potentially on the brink of financial collapse.

Best Strategies for Finding Distressed Properties

Unearthing distressed properties is an artful blend of intuition, diligent research, and effective networking. The adept investor employs a variety of strategies to unearth these hidden gems, from scouring online resources to leveraging local connections and exploring neighborhoods in person. Each method offers its own advantages, and when combined, they form a robust approach to locating distressed properties ripe for investment.

Online Resources

The digital age has opened a treasure trove of online resources for locating distressed properties. Real estate listing websites, including distressed property websites, are filled with pre-foreclosures and foreclosures, good for filtering and discovery.

Find distressed properties using Batchleads

- Driving for Dollars: BatchLeads mobile app with the driving for dollars feature helps you find opportunities that no one else is looking for and build higher quality real estate leads. With BatchLeads 3.0, you can easily track your routes, add leads to your lists, and unlock the property insights you need to approach motivated sellers with confidence!

- Property Search : Use BatchLeads property search and tap into over 122M properties to choose from across US. Go geo specific and find hyper local real estate properties that showcases various distress factors. Use list stacking to create custom property lists easily with the click of a button.

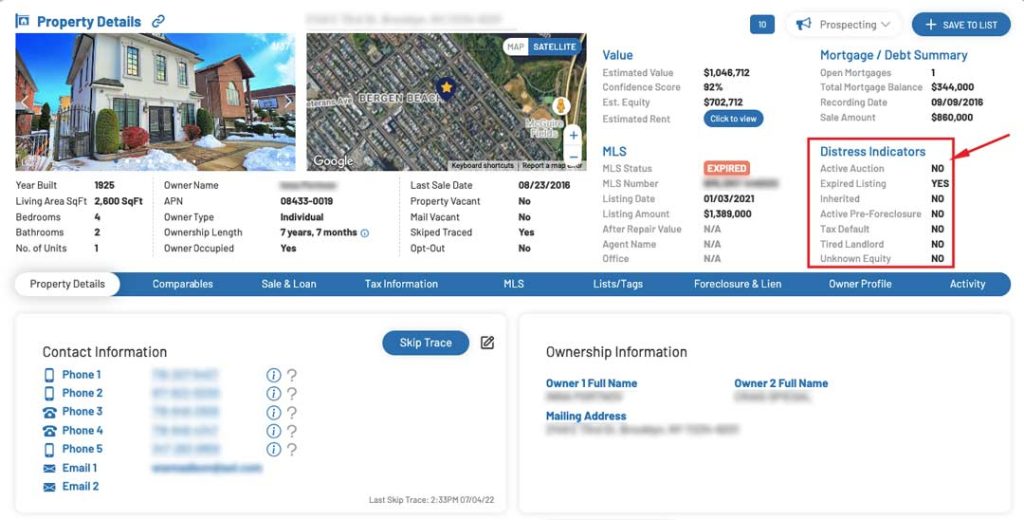

- Distress Indicators: BatchLeads property details view is now showcasing with various distress indicators such as Active pre foreclosure, Expired listing, Tax Default, Tired landlord, Unknown equity etc which one can use to segment properties under the same category and create dedicated lists there by generating focused and higher quality leads.

Finding properties using Multiple Listing Service (MLS) : Entry to such vast data requires real estate licence and thus only for real estate agents. Including a dedicated real estate agent, adds another layer to the online search arsenal, despite the competition from other investors using similar platforms.

Local Networking

The local scene holds untapped potential for finding distressed properties. Real estate agents, often privy to pre-market listings and upcoming foreclosures, can become invaluable allies in the quest for distressed real estate. Networking with legal professionals can also yield leads, as attorneys may come across properties tangled in divorce or estate settlements.

Developing relationships within the local market can thus provide a competitive edge in the pursuit of distressed properties.

In-Person Searches

Sometimes, the most effective way to find distressed properties is to hit the pavement. Local property auctions offer a more direct approach, where properties are sold to the highest bidder, often on a cash-only and ‘as is’ basis.

Engaging with homeowners before an auction can also provide insights into the property and an opportunity to negotiate a pre-auction sale.

Due Diligence and Property Analysis

While distressed properties can be alluring, successful investment relies heavily on due diligence and thorough property analysis. Before taking the plunge, every aspect of the property, from its physical condition to market value and legal standing, must be examined thoroughly to ensure the investment is sound and profitable.

Property Inspection

A thorough property inspection is the cornerstone of due diligence, shedding light on potential issues and defects that could impact the investment. The inspection should cover the following components:

- Foundation

- Roof

- Plumbing system

- Electrical system

- HVAC system

- Exterior walls

- Windows and doors

- Flooring

- Interior walls and ceilings

- Appliances and fixtures

Each component must be evaluated for integrity and repair costs.

Teaming up with a qualified property inspector is crucial for obtaining an accurate assessment, which serves as a guide for negotiating the offer if significant problems are identified.

Market Research

Market research is the compass that guides investors through the valuation process. It involves analyzing local trends, infrastructure projects, and comparing recent sales to determine the property’s market value and inform offers. Conservative offers, underpinned by a solid understanding of the market and comprehensive underwriting, safeguard against overpaying and help manage risks.

This research, coupled with sensitivity analyses, prepares investors for possible market shifts that could affect their investment.

Legal Considerations

Legal due diligence is as essential as the physical and financial aspects of a property. A review of the title history can uncover past disputes or issues that could haunt the new owner.

Ensuring that the property complies with local zoning laws is also vital, as these regulations dictate the permissible uses of the property and affect its value.

Learn more about the Do’s & Dont’s of rehabbing distressed properties.

Approaching Distressed Property Owners

Communication with distressed property owners is a sensitive task, requiring tact, empathy, and a clear comprehension of their situation. The initial conversation sets the tone for the entire negotiation process, and it is crucial to approach each property owner with solutions that address their needs and respect their circumstances.

Communication Strategies

Effective communication with distressed property owners hinges on empathy and clarity. Tailored direct mail campaigns can strike a chord by offering assistance and resonating with the owner’s specific situation. Community workshops and partnerships with local professionals provide additional support to homeowners.

Social media and SEO can also broaden outreach, ensuring distressed owners find the help they need. Success stories and persistent follow-up are key to building trust and guiding homeowners towards beneficial decisions.

Direct Mail Campaigns

Direct mail remains a tried-and-true method for reaching distressed property owners. A well-crafted letter expressing genuine interest in purchasing their property can open doors to negotiations. This direct approach is particularly effective with owners who are out-of-state and may be more inclined to sell a property that has become a burden.

>> Learn Direct Mail Hacks : A Step by Step video guide

Financing Options for Distressed Properties

Financing distressed property investments can be complex, given the potential risk aversion from traditional financing options. Understanding the various financing avenues available is crucial for investors to navigate this challenging aspect of distressed property investment.

Traditional Mortgage Loans

Securing a traditional mortgage loan for a distressed property involves a meticulous examination of the buyer’s financial health and the property’s value. The process includes:

- An assessment of income, debts, credit history, and the size of the down payment

- Traditional lenders may be reticent due to the property’s condition

- A well-prepared buyer has a better chance of obtaining approval.

Hard Money Lenders

For investors seeking a swifter financing route, hard money lenders offer a viable alternative. These loans prioritize the property’s potential over the borrower’s creditworthiness, facilitating quick deals despite higher interest rates. Lenders like Socotra Capital can fund a significant portion of the purchase and rehab costs, with terms tailored for short-term projects.

For long-term investments, such as rental properties, hard money loans with extended terms are available.

Creative Financing Strategies

Creative financing strategies can unlock opportunities that traditional loans cannot. Some examples of these strategies include:

- Cash-out refinance

- Seller financing

- Lease options

- Bridge loans

- Purchasing distressed loans directly from lenders

These strategies provide flexibility for investors to secure distressed properties and bypass the auction process.

Successfully Investing in Distressed Properties

Success in distressed property investment is achieved through a combination of knowledge, strategic planning, and a robust network. By understanding the intricacies of this niche market, investors can elevate distressed properties into profitable assets, creating value through renovation and shrewd management.

Choosing the Right Investment Strategy

Selecting the appropriate investment strategy is crucial for success in the distressed property market. Whether opting for long-term rental properties, engaging in quick fix-and-flip projects, or employing BRRRR investing, each approach requires a different set of skills and resources. It is vital to assess the potential profitability and risks of each property before settling on a strategy.

Building a Team

Distressed property investment is not a one-man show. Assembling a team of experienced contractors, wholesalers, and real estate professionals is essential for estimating repair costs and finding the best deals.

A strong team can provide the support needed to navigate the complexities of distressed property investment.

Scaling Your Investment Portfolio

Expanding an investment portfolio with distressed properties often means utilizing rental properties as part of a long-term strategy. This approach can lead to wealth accumulation, especially when the rental income is sufficient to cover maintenance costs and the market conditions are poised for growth. It’s a play that requires patience and a keen eye for properties with the potential for value appreciation over time.

Summary

In the realm of distressed properties, the saying ‘one man’s trash is another man’s treasure’ rings true. Through understanding the types and indicators of distressed real estate, employing varied search strategies, conducting diligent property analysis, and approaching owners with empathy, investors can turn these overlooked assets into profitable ventures.

Creative financing options and building a solid team further empower investors to scale their portfolios and succeed in this challenging yet rewarding field. Let this guide be your map to the treasure trove of opportunities that distressed properties offer.