If you aren’t watching the real estate trends that have popped up in the first quarter of 2022, you’re missing key information.

Here’s what we’ve seen on a global scale so far:

- War

- Potential interest rate hike

- Decade-high inflation

- Relaxed COVID regulations

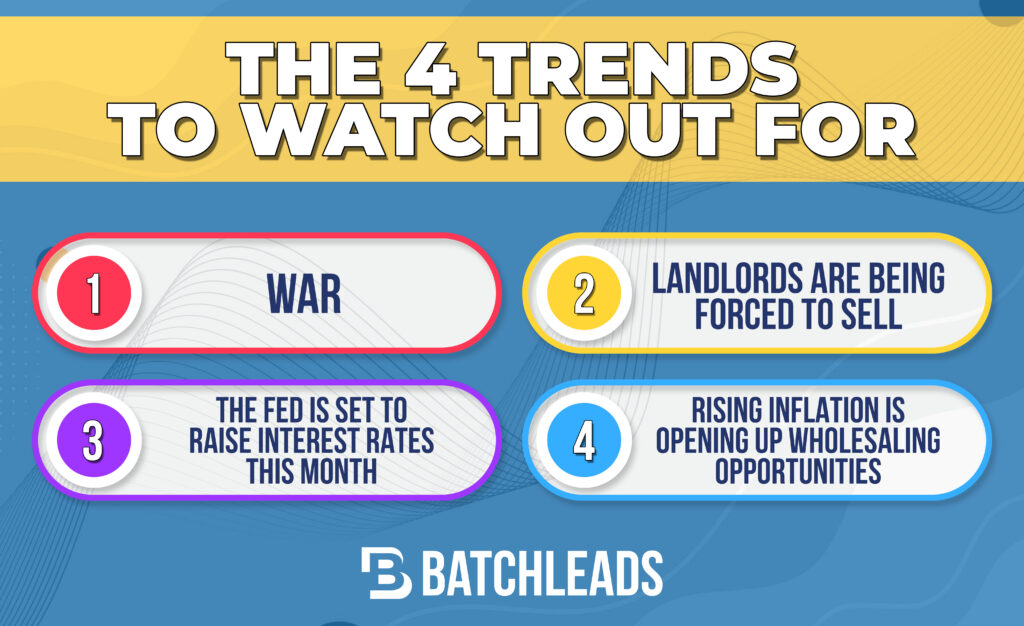

With all of the changes we’re seeing on national and international levels, you can expect the real estate industry to show some reaction. Of course, no one knows exactly what’s going to happen next, but if you aren’t keeping track of these trends, you might miss great opportunities or find yourself on the wrong end of some big losses. So here are 4 trends you should watch for the remainder of 2022.

War

The end of February brought something world leaders feared for a while: a Russian invasion of Ukraine. However, many world leaders didn’t seem to anticipate Russia’s wider threats against other countries.

While other nations have given little to no ground support to Ukraine, the US and several key European countries have upped defense budgets and moved troops to strategic positions if these threats of widespread aggression turn out to be legitimate.

As of now, no one knows exactly what will happen, but a wider conflict will undoubtedly impact real estate as uncertainty may cause many investors to stop buying. However, war could also negatively impact the economy, creating an abundance of motivated sellers and leading some cash buyers to embrace the risk of purchasing in an unstable market.

Landlords Are Being Forced to Sell

The last two years have been hard on landlords. State and federal policies have prevented evictions, and many tenants have lost their jobs or had significant changes in how their jobs functioned. As a result, many landlords have missed out on months or years of unpaid rent.

Many landlords are selling to cover mortgage payments or get away from the stress and frustration of ownership.

This may create favorable conditions for wholesalers or fix and flippers. While the market is inflated right now, landlords looking to sell will still create deals. Just be sure to have a good cash buyers list before you sign any contracts so that you don’t get stuck with a property you don’t want to keep.

The Fed Is Set to Raise Interest Rates This Month

You’ve probably heard people talk about this one for a while, but the Federal Reserve is set to raise interest rates this month.

Investors should keep their eyes on these developments because increased rates will raise the cost of mortgages and other loans. This will probably cause buying to slow. However, this could raise the percentage of cash buyers in the market because they don’t rely on mortgages. Whether this will affect property prices, though, remains to be seen.

Rising Inflation Is Opening up Wholesaling Opportunities

As unfortunate as it is, rising inflation and lowered purchasing power create motivated sellers, especially in the most expensive cities and states. As the cost of goods increases and many wages stay the same, homeowners see their budgets get tighter and tighter. These conditions mean more opportunities are popping up daily for real estate investors and wholesalers.

While some of these trends might seem concerning, don’t worry! If you’re willing to roll with the punches, every situation will be full of opportunities. Whether it’s advancing technology, increasing inflation, an economic downturn, or even war, you can find a way to come out on top if you keep up with the correct information, insights, and resources!