When investing in real estate, knowing how to accurately comp (compare) and evaluate properties is essential for success. Without proper comping, investors risk overpaying, miscalculating rehab costs, or struggling to resell at a profit. BatchLeads make it easier by providing real-time, accurate comps to help investors make data-driven decisions. In this guide, we’ll walk you through the steps to effectively comp and evaluate properties with BatchLeads, integrating insights from the Comping Cheat Sheet to enhance your workflow.

What Is Comping and Why Is It Important?

Comping is the process of finding and analyzing comparable properties (or “comps”) to determine a property’s current market value or After Repair Value (ARV). It involves examining similar properties that have sold recently to estimate the subject property’s potential value.

Accurate comping helps real estate professionals:

- Accurate Pricing: Prevents overpaying for a property or undervaluing a deal.

- Better Investment Decisions: Ensures you buy properties with enough profit margin.

- Stronger Negotiation Power: Helps justify your offer price with data.

- Essential for ARV Calculation: Affects fix-and-flip, wholesaling, and buy-and-hold strategies.

BatchLeads simplifies this process by offering powerful tools to locate comps, analyze market trends, and calculate ARV, all within a single platform.

Step-by-Step Guide to Comping in BatchLeads

Step 1: Find Comparable Properties

BatchLeads streamlines the process of locating and analyzing comparable properties with intuitive search features and multiple access points. Here’s how you can quickly access property details and evaluate comps:

- Property Search: Look up a specific property and access its details.

- My Lists: Pull a saved list of properties and get property info directly from there.

- Inbox: While texting a lead, you can open the property details seamlessly.

Once you open up a property details page, it’s hard to miss the ‘Comparables’ tab

- Navigate to the “Comps” tab to view recently sold properties.

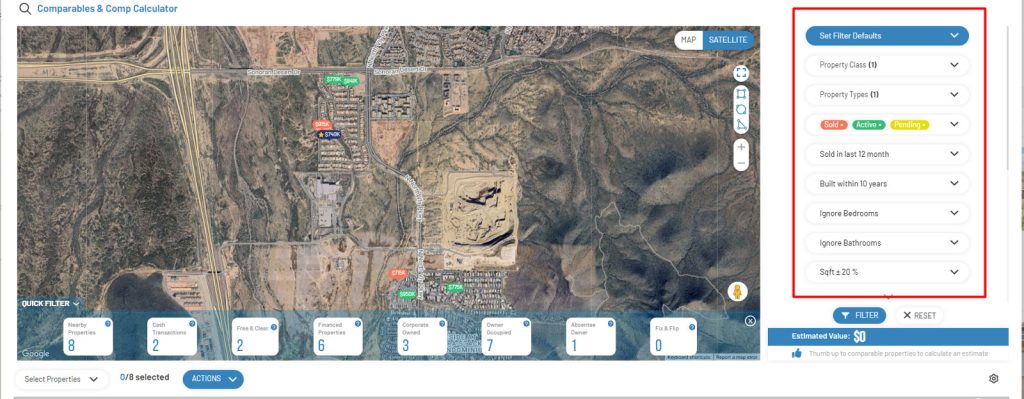

- Use filters such as:

- Property type

- Square footage

- Year built

- Location

Tip from the Comping Cheat Sheet: Only use comps no older than 180 days. If you must use older comps, adjust the ARV by reducing it by 10-20% to account for market changes.

Step 2: Narrow Down Your Comps

To ensure accuracy, refine your search to properties that closely match your subject property.

- Stay within the same subdivision: Avoid crossing major roads or geographic boundaries.

- Match property characteristics: Choose properties within ±250 sq. ft. of your subject property’s size.

- Default build year is ±10 years, you can tweak it for longer period but keep in mind that additional maintenance could be involved.

- Make sure you only select ‘SOLD” listings so that you understand what the market is currently paying for.

Note: You can always save the customized filter with the name of your choice under “Set filter defaults” tab for quick access in future.

Step 3: Evaluate Market Trends

BatchLeads already provides access to active, pending, and sold listings, enabling you to have control over what market direction to choose from. Look at inventory trends over the last 3-6 months to understand whether the market is heating up or cooling down. Being in sync with the market trend is crucial for a real estate investor. Below are some of notable insights on what to account for ARV calculation based on changing market dynamics.

- Adjust your ARV as needed. For example, increase ARV by $10,000-$25,000 in a hot market, or reduce it in a declining one.

- Bedrooms and Bathrooms: Adjust ARV by ±$10,000-$25,000 for differences in bedroom or bathroom count.

- Garages and Pools: Add $10,000 for garages or pools in moderate climates, or up to $25,000 in extreme climates.

- Lot Size: Only compare properties with lot sizes within 2,500 sq. ft. of each other.

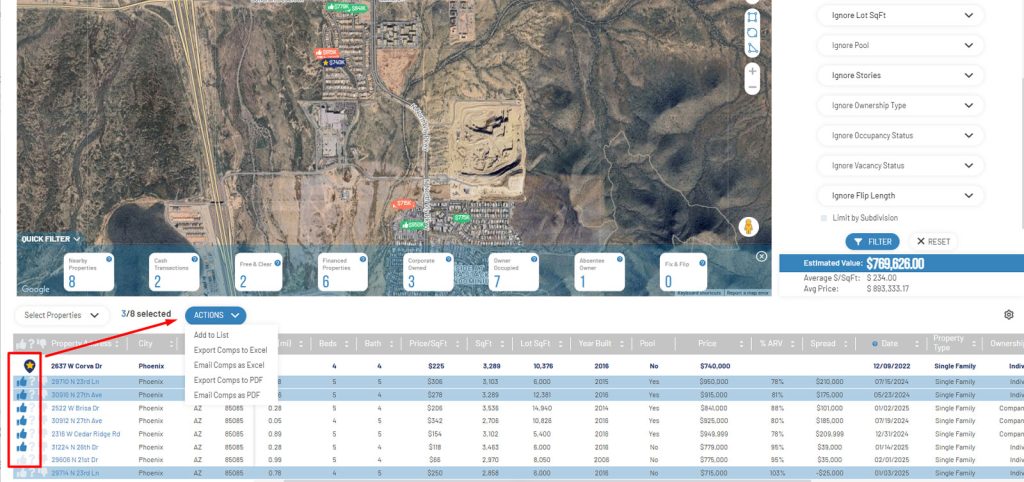

Step 4: Exporting Comparable Property List

The next step is to compare and select the best fit properties from the list which immediately reflects on the “Estimated Value” section where Batchleads does the ARV calculation for you based on the ARV Formula. This quick calculation helps you select the desired properties from the list with ease and with the click of a button you can export the list as PDF or Excel. Each export will be sent to your registered email so that you can continue tweaking the filters and search for more properties.

Additional Features in BatchLeads to Enhance Comping

AI Powered Lead Targeting – BatchRank AI

Batchleads is an advanced real estate investing tool yet with an easy to understand user interface. In our latest game changing updates rolled out in Q4 2024, we introduced an AI based propensity scoring tool called BatchRank AI which already proved to be a powerful targeted lead generation feature. Batch Rank processes data from over 150 million properties and 800 data points. This revolutionary filter cuts down the time spent manually sorting through data, delivering a targeted lead list in seconds.

Learn more about Batchrank AI from the below walkthrough!

Low Latency Data

Being a frontrunner in the proptech and data space, we understand the importance of data latency and its immediate benefits to our customers more than anyone else. Batchleads aims to reduce data latency which measures the time it takes for new data to appear on the platform. For example, when a property gets listed on the local MLS, it may take 24 to 48 hours to show up on a platform like Zillow. So reducing the delay and getting properties visible to you faster than our competitors can make the difference between closing a deal or missing out.

Seamless ARV Calculations

BatchLeads automatically calculates ARV based on the comps you select instantly, saving you time and reducing errors. Below given is the ARV formula used to calculate the approximate value of the property that you want to buy.

How to Use the Comping Cheat Sheet

The Comping Cheat Sheet is an easy to follow step-by-step guide to help upcoming real estate professionals refine their property evaluations. Key highlights include:

- Adjust for Market Trends: Modify property valuation based on whether the market is heating up or cooling down.

- Traffic and Commercial Impacts: Deduct value for properties near major roads or commercial areas (e.g., subtract $20,000-$40,000 for homes fronting major roads).

- Climate Adjustments for Garages: Add up to $25,000 for garages in areas with extreme climates.

You can download the full Comping Cheat Sheet by Jamil Damji to keep these essential tips handy while evaluating properties.

How Accurate Comping & ARV Impacts Different Real Estate Investment Strategies

Overestimating a property’s value can lead to poor investment decisions, while underestimating it can result in missed opportunities. After Repair Value (ARV) plays a crucial role in short-term real estate strategies, helping investors make informed decisions and maximize profits. Whether you’re wholesaling or flipping, understanding ARV is key to securing the best deals.

For Wholesalers:

- ARV helps determine the ideal contract price before assigning the deal to a cash buyer.

- Cash buyers use the 70% rule, so securing a lower purchase price increases your wholesale fee.

- The better the deal, the more attractive it is to investors, ensuring quicker assignments and higher profits.

For Fix-and-Flip Investors:

- Accurate ARV calculations help determine a profitable purchase price before investing in renovations.

- Overpaying due to rough estimates can shrink margins and increase risk.

- Buying at the right price ensures you maximize ROI while minimizing losses.

No matter your strategy, ARV serves as the foundation for smart investment decisions, risk reduction, and higher profitability.

Conclusion

Comping and evaluating properties doesn’t have to be complicated. With BatchLeads and the guidance of the Comping Cheat Sheet, real estate professionals can accurately determine ARV, analyze market trends, and make data-driven decisions.

By leveraging BatchLeads advanced AI powered tools and adhering to proven appraisal rules, you can maximize your efficiency, minimize risks, and secure better deals with ease.