For real estate investors, a property’s after repair value (ARV) determines whether a property is worth buying or not. With investing, the last thing you want to do is to put all of your time and resources toward an investment that yields little to no profit. An ARV calculator can help, making it an invaluable tool when you’re evaluating potential investment properties.

How do I calculate ARV?

To accurately calculate the ARV of a property, you’ll need to find comparable properties, or “comps” for your property. Comps are recently sold properties that are near the property you’re considering that share similar floor plans, measurements, lot sizes and features. In order to find comps, you can work with a real estate agent or use a real estate comparables tool. A comping tool will identify comps within a set radius of the property.

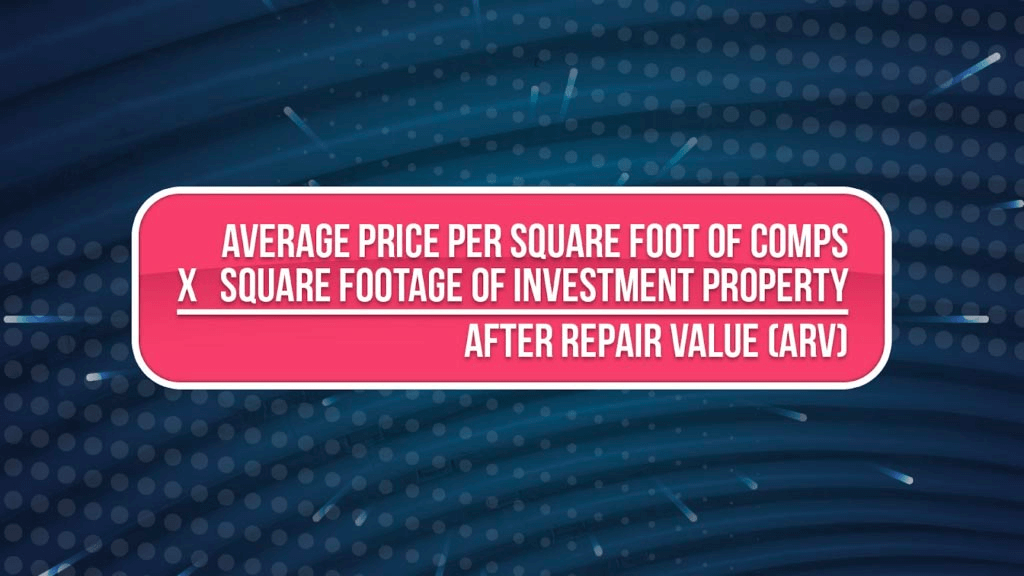

Next, you’ll need to use your ARV calculator to determine your offer. The first step is to calculate the average price per square foot of your comps. That may be in the listings, but if not, you can simply divide the home’s sale price by its square footage. This will give you the price per square foot. Once you have that information, multiply the price per square foot by the square footage of the property you’re considering.

Using an ARV calculator to determine the price you should offer

Now that you have a fair and reasonable price for the property, you should use that to make an offer, right? Not so fast. You’ll want to use the 70 Percent Rule to determine your offer. The rule states that when making an offer on distressed properties, you should take 70 percent of the property’s ARV, subtract the estimated repair cost, and that number is your offer.

When you use the ARV calculator to determine your maximum offering price, you’re in an excellent position to demonstrate to the homeowner that this is a reasonable offer. Selling a distressed property is an emotional experience, and some sellers may assume that they’re being taken advantage of. By showing the seller your numbers, they will be more likely to accept your offer.

As we say at BatchService, “Data is king.” When it comes to making an offer on a distressed property, having comp data will help you ensure that your offer is reasonable and reflects current market value.