There are countless real estate investing strategies that you can use to grow your income and build wealth. But if you’re looking for a way to make money on a monthly basis, then building a portfolio of rental properties is the option of choice for most real estate investors.

But it presents a problem: if you want to make a significant amount of money every month, you need several properties that you can rent consistently. Unless you have the time and resources to generate investment leads full-time, this may keep you from building a sizable passive income stream.

The good news is that you don’t have to own several properties to create multiple sources of passive income. With multi-family real estate, you can purchase a single home with two or more living areas and then find a tenant for each of them. However, there are far fewer multiplexes than single-family homes, meaning that finding the perfect property can be a challenge. So in this blog, we’ll give you a step-by-step guide to multi-family real estate investing.

Benefits of investing in multi-family real estate

Before we dive into how you can find a great multi-family property, let’s focus on why these properties make such great investments.

Rental income

With a multi-family property, you have several separate units, so you can provide private, safe places for multiple families to live. This allows you to create multiple revenue streams from a single investment!

Scalability

Multi-family investments vary significantly in cost. Some multiplexes are priced similarly to single-family residential properties, while apartment buildings can often cost millions of dollars. The good news is that they offer economies of scale. Often, the cost per unit decreases as the number of units increases, meaning you’re improving your ROI with every unit you purchase. These properties also offer scalability because they can cash flow faster than single-family homes, meaning you’ll open the door to larger investment opportunities in time.

Lower risk

If you invest in a single-family home and can’t find a tenant, your asset turns into a liability. But if you own a multi-family property and you lose a tenant, you’ll still have others to cover the cost of the building while you search for a new renter.

Appreciation

Nearly all real estate investments appreciate over time, but this is especially true of multi-family properties because they give the buyer an opportunity for a cash flow investment. If you decide to liquidate your portfolio in the future, you’re nearly guaranteed to make a profit on the sale.

Tax benefits

Like appreciation, all real estate investments create tax benefits, but it’s especially true when you’re renting to multiple people. Because you’re providing housing to a number of individuals, you may be eligible for certain tax breaks depending on the city and state where your investment is located. You can also claim deductions based on depreciation, property taxes, interest on mortgage payments, repairs, and maintenance.

Finding the perfect multi-family property

As you can see, there are a lot of great benefits to multi-family real estate investing. So if you’re ready to find the perfect property, let’s dive into what you should be looking for!

Step 1: Determine your investment goals

Before you start looking for a property to buy, you need to clearly define your goals, because they’ll determine where you’re going to look and what features matter most. Sit down and make a list, including:

- Your budget

- What kind of tenants you want

- Do you want families, young professionals, college students, etc.?

- How involved in the property you want to be

- Your investment timeline

- How many units you want to own

- Whether you want to house hack or live in one unit and rent the rest

Each of these factors will influence the type of property you buy. By considering them before you start looking, you can limit your search to the right properties, which will save you a lot of time and keep you from making an impulsive decision that doesn’t fit your strategy just because something seems like a good deal.

Step 2: Research the local real estate market

Once you know what kind of property you want to buy, you can start your search. The first step is to identify the economic opportunities in your target market. If there are employment opportunities, colleges and universities, and interesting attractions, then you probably won’t have trouble finding tenants. But if there aren’t many reasons for someone to rent and live in your market, you might want to expand your search to a new location.

Once you’re sure that people have a reason to rent in your target market, you can start looking for properties. There are two primary ways to find your investment property: on-market and off-market deals. On-market deals are properties that are listed on the multiple listing service (MLS) and are actively for sale. To find these, you can work with a real estate agent or simply focus on properties with for sale signs. Off-market properties, on the other hand, aren’t technically for sale. However, they can make excellent deals because they often sell for below-market value.

This is because while off-market properties aren’t actively listed, the owner may be ready to sell the property. For example, if a building is owned by an absentee owner or a tired landlord, the responsibilities and expenses of property management may have become more burdensome than profitable. If the owner has enough equity in the property, then they may be able to make a net profit by selling to you, even if you offer less than the property is worth in today’s market.

This may seem far-fetched. After all, who would sell their property for less than it’s worth? However, this situation is more common than you might think. Aging landlords often want to liquidate their portfolios, but investing the time and money to fix property damage, list with a realtor, and then deal with a lengthy closing process is often more of a hassle than it’s worth. If you can offer the convenience of a cash sale or a creative finance deal, you may be able to buy an off-market multi-family property at a significant discount.

So do you have to rely on luck to find a situation like this? Not at all; real estate lead generation software has made it easy to find the perfect off-market property for your real estate dreams! In the first step, we identified the features you want in your property. The benefit of doing that first is that you can use these features to filter results in your lead gen platform!

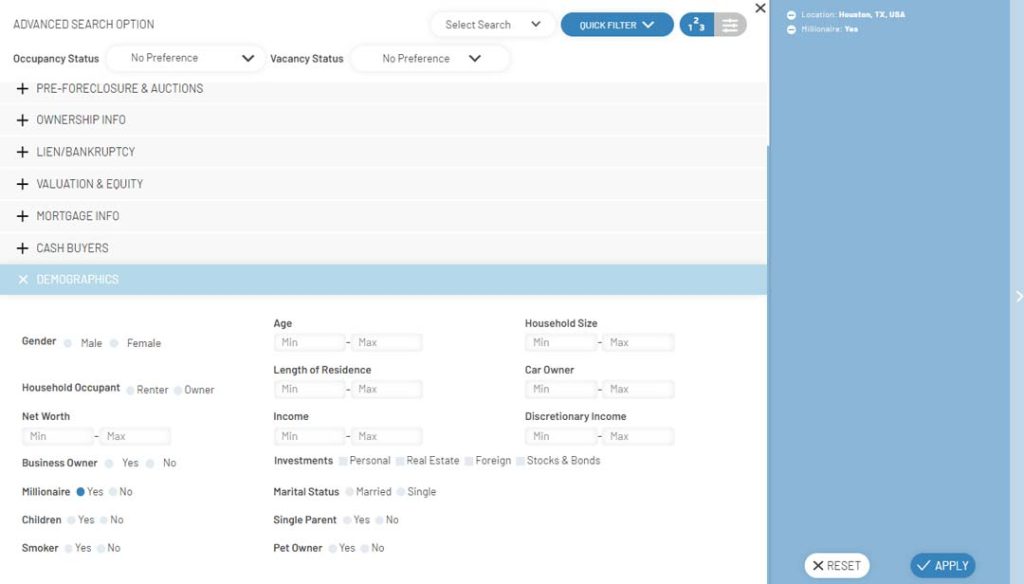

If you’re using the right software, you’ll have access to in-depth filters that will help you find properties that meet your exact criteria. For example, BatchLeads will give you over 300 unique filters that you can use to find off-market properties with specific criteria and owners who are likely to sell for a discount. With this software, you can quickly create a healthy list of opportunities that you want to learn more about.

Step 3: Comp your deal

Don’t let yourself fall in love with a property just yet. It’s important to run the numbers before you decide that you want to buy, especially when it comes to a multi-family investment. This process is known as comping, and it’s the single most important step in buying a multi-family property.

Comping a deal will show you how much a property is worth and help you determine how much you can rent each unit for. To comp a property, you’ll find a handful of recently sold properties near the deal you’re interested in. These properties are called comps, and they should have the same number of units, a similar lot size, similar unit square footage, and similar on-site amenities. They should also be in similar neighborhoods and be a similar distance from key attractions.

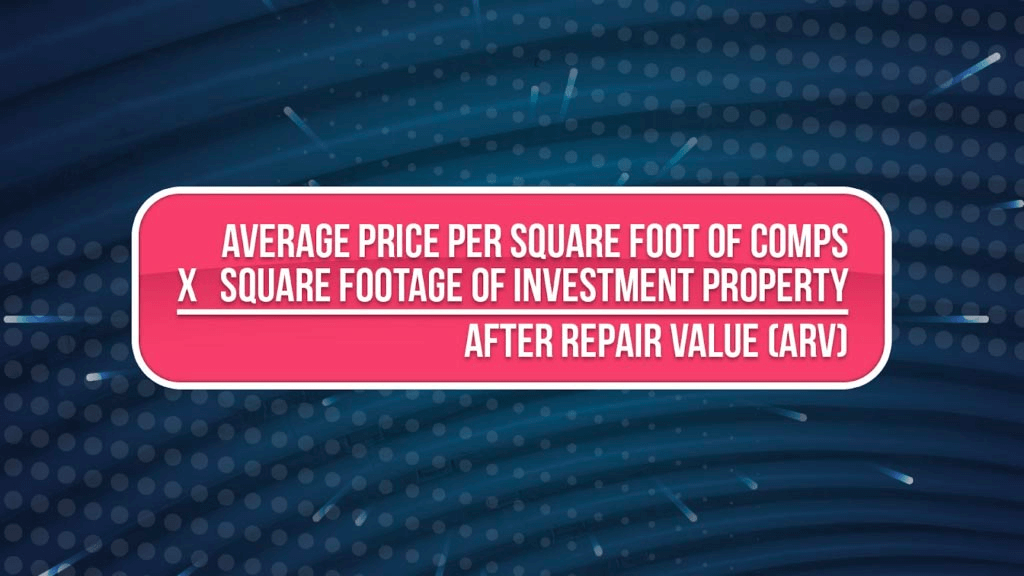

Once you find several comps, you’ll average their sale price per square foot and multiply it by the square footage of your deal to find out your property’s after repair value (ARV). Of course, manually finding these properties can be challenging. The best option is to use a comping tool that will find comps and do all the math for you. BatchLeads has a comping tool built in, and it even uses home sales data to make sure the sales prices you’re relying on to calculate your deal’s value are accurate and reliable.

Once you know a property’s value, it’s also important to consider your financing options, interest rate, property taxes, and utility costs. Knowing these details will help you determine if you can afford the initial purchase and then make enough money on rentals to cover the mortgage and generate monthly income.

Step 4: Contact the owner and make an offer

If your numbers are right, then it’s time to connect with the owner and get the property under contract. This is a notoriously difficult part of the process, because the owner rarely lives at the property. To make matters more challenging, many multi-family properties are also owned by holding companies or LLCs, which hide the owner’s name and information.

But once again, if you have the right real estate lead generation platform, this won’t be a problem for you. With the click of a button, you can skip trace the property to find out who actually owns it and uncover their phone number and email address. Once you have this information, you just need to call, email, text, or send a letter to the owner.

If they’re receptive, you can start negotiating on price from there. Just remember that the best way to get a discount on the property is to offer convenience. If you have money, offer a quick, cash sale. Otherwise, consider some kind of creative financing option that will make the process as fast and easy as possible.

Step 5: Inspect the property

The final step before you close on the property is to inspect it. When you’re buying single-family rental homes off-market, you don’t always need a thorough inspection since you’ll likely be renovating or repairing the property. But when it comes to multiplexes and apartment buildings, there’s a lot more to look into.

Unless you’ve worked with properties like these before, we highly recommend hiring an experienced inspector. They can make sure there aren’t any code violations or structural issues that would endanger your residents, create potential lawsuits, or cause local municipalities to deem the building uninhabitable.

(Optional) Step 6: Hire a property management company

Multi-family real estate investing can be lucrative, but it can also be time consuming and frustrating. Interviewing tenants, providing maintenance, and dealing with problems can quickly turn into a full-time job.

Hiring a property management company to handle these tasks can ensure that your investment remains a passive venture. In exchange for a portion of the rent, they’ll handle all the building and tenant operations. However, this can be expensive, so be sure to consider all the numbers including your net operating income (NOI) before you contract with a company. Otherwise, you could be surprised to find that your investment isn’t paying nearly as much as you predicted.

Conclusion

Multi-family real estate investing is a unique but highly-profitable business strategy. Unlike investing in single-family real estate, it lets you build multiple streams of income from a single property.

But finding and buying a multi-family property is also more challenging than finding a single-family home. There are fewer options available, they’re initially more expensive, and making a wise investment takes more research. Managing them on your own also takes more work.

But none of these difficulties can negate the sheer profitability that comes with renting to multiple families at once. Not only can you make more money, but you’re also protected from the cash flow problems that come with single-family vacancies. You’ll also make far more money over time as your rental income adds up and your asset appreciates. Simply put, multi-family real estate investing is a must if you can afford to add a larger property to your investment portfolio.