Interested in real estate investing or seeking to improve your returns? This guide demystifies the best strategies for property investments in 2024. You’ll gain insights into selecting the right properties, navigating financing options, and identifying value-enhancing renovations. We will also introduce you to advanced strategies that seasoned investors use to optimize their portfolios. Here’s where you’ll find the pragmatic advice needed to make informed and profitable real estate investment choices.

Key Takeaways

- Real estate investment offers various types including residential, commercial, and land development, each with unique opportunities and risks; diversifying across these types can enhance portfolio stability and potential returns.

- Financing real estate investments is multi-faceted, with options ranging from conventional to alternative financing; strategic financial planning and understanding the impact of financing on investment profitability are crucial.

- Effective marketing strategies, such as hosting open houses, and establishing a strong online presence, are key to connecting with potential buyers and selling real estate investments successfully.

Exploring Real Estate Investment Types

The realm of real estate investment is as diverse as it is lucrative, offering a variety of avenues to build wealth. Whether it’s the allure of residential properties, the robustness of commercial real estate, or the vision that comes with land development, each type of investment carries its own set of opportunities and challenges. Understanding the distinctions and potential of these categories is the cornerstone of crafting a thriving investment strategy.

You can also try out our Free Course on Intro to Real Estate Investing to systematically understand the basics and get certified.

Residential Investments

Residential real estate forms the backbone of many investment portfolios, with its promise of steady rental income and the potential for long-term property appreciation. From the humble single-family home to sprawling apartment complexes, residential properties cater to a fundamental human need—shelter. As a result, they present a consistent demand that shrewd investors can tap into for sustained financial gains.

Venture out to find off market properties, which are considered hidden gems in the real estate realm. The more competitive your market conditions, the higher the chances you’ll find one and make good deal out of it.

Commercial Real Estate Ventures

Venturing into commercial real estate introduces investors to a world where businesses thrive and leases stretch on for years. This sector encompasses everything from office buildings to retail spaces, offering the potential for higher rents and stable cash flow. However, the landscape is changing, and staying attuned to trends such as the shift in office space utilization is key to making astute commercial investments.

Check out this case study on Crexi and how they leveraged commercial real estate data from BatchData API to supercharge their platform with accurate , competitive and clean data.

Crexi’s Director of Product Management, Chris Finck, quotes, “We want to supplement your work and make you superhuman so you can do things in seconds not hours. That’s where BatchData comes in. What used to take our users 30 minutes now takes them 30 seconds.“

Land Development and Investment

Land investment is the canvas of the real estate world, brimming with potential for those with the vision and understanding of how to navigate its complexities. Zoning regulations, development plans, and government incentives all play pivotal roles in transforming raw land into profitable endeavors.

Mastering this domain requires a strategic approach that aligns with market demands and legal frameworks.

Building a Successful Real Estate Portfolio

Building a real estate portfolio that stands the test of time is akin to constructing a fortress—it requires a solid foundation, strategic planning, and an eye for opportunity. Diversification is the watchword, ensuring that your investments are spread across different property types to balance risks and enhance potential gains.

The goal is to create a portfolio that generates consistent income while also appreciating in value over time.

Asset Allocation Strategies

Effective asset allocation is the art of spreading your real estate investments across a spectrum of opportunities to mitigate risk and enhance returns. Diversification is key, as it allows investors to weather market fluctuations with greater stability.

Real Estate Investment Trusts (REITs), for instance, offer investors a slice of commercial real estate without the need to directly own the property, providing liquidity and professional management along with the diversification benefits.

Managing Investment Risks

While the potential rewards of real estate are enticing, it’s important to navigate the terrain with a clear understanding of the risks involved. From property-specific concerns to broader economic shifts, a proactive risk management approach is essential. With key property concerns being:

- Damage

- Vacancy

- Maintenance costs

- Tenant issues

For those in the flipping houses game, the stakes are particularly high, demanding an even greater emphasis on due diligence and meticulous financial planning.

Growth Opportunities in Real Estate

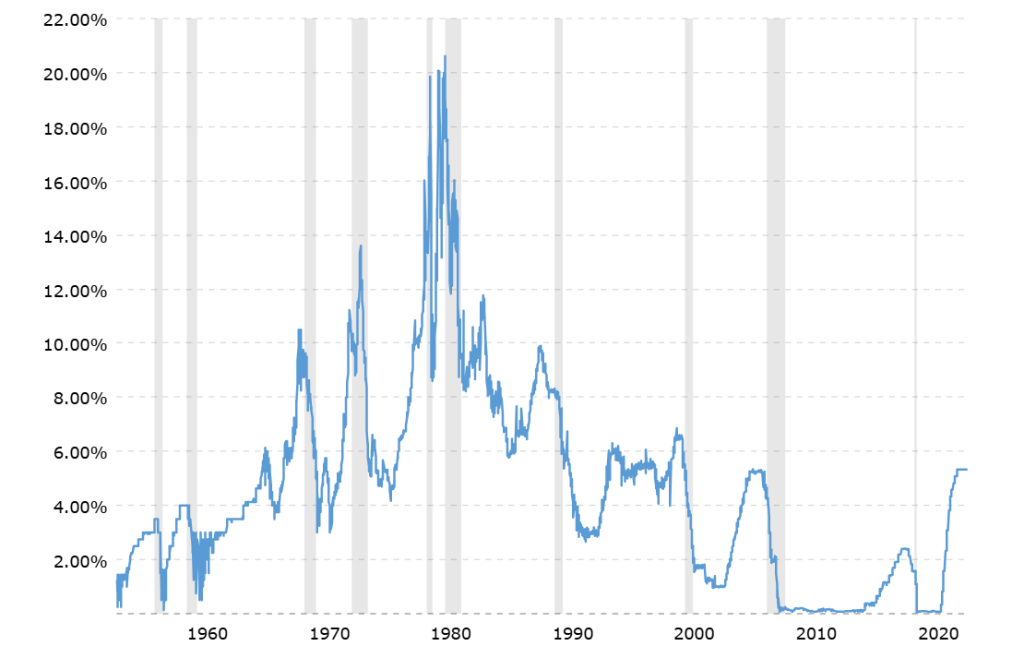

The real estate market is ever-evolving, and growth opportunities continually emerge, often influenced by larger economic forces such as Federal Reserve interest rate policies. Keeping a finger on the pulse of these trends can uncover promising sectors for investment within the real estate industry.

As inflation stabilizes, the playing field may become more favorable for real estate investors looking to expand their portfolios and capitalize on new opportunities.

Financing Your Real Estate Investments

Securing the right financing is a critical step in the real estate investment journey. Several options being:

- Conventional loans

- Hard money loans

- Private money loans

- Portfolio loans

- FHA loans

- VA loans

- 203k loans

- Seller financing

- Crowdfunding

- Self-directed IRAs

Investors, who are often property owners themselves, have the ability to tailor their financing approach to their individual needs and the unique demands of their investment properties. Navigating this landscape with knowledge and foresight can make all the difference in maximizing investment potential.

Mortgage Financing

Mortgage financing remains a cornerstone of real estate investment, offering a leveraged path to property ownership. Understanding the requirements and strategies for securing a mortgage is crucial, as it can affect the profitability of an investment property.

From down payment percentages to reserve requirements, each aspect of mortgage financing has a direct impact on the terms and cost of the loan.

Alternative Financing Options

Beyond traditional mortgage financing, the world of real estate investment is rich with alternative funding sources. From the collective power of Real Estate Investment Trusts to the flexibility of private money loans and joint ventures, these options provide creative ways to finance properties.

With the right approach, alternative financing can unlock doors to properties that might otherwise be out of reach.

Financial Planning for Investors

Financial planning is the compass that guides real estate investors through the uncertain seas of the market. It’s not just about choosing the right financing methods; it’s about understanding tools like the 1% rule and managing liquidity to ensure that each investment adds to a profitable and sustainable portfolio.

A strategic approach to financial planning can make the difference between a fleeting opportunity and a long-term investment.

Enhancing Property Value Through Renovations

Renovations can be a transformative force for real estate properties, unlocking hidden value and increasing market appeal. From strategic updates like:

- Garage door replacements

- Kitchen remodels

- Bathroom renovations

- Landscaping improvements

- Adding a deck or patio

- Installing energy-efficient windows

To more significant overhauls, the right improvements can significantly boost a property’s value. The key is to identify which renovations will yield the highest return on investment and enhance the property’s attractiveness to potential buyers.

Cost-Effective Renovation Tips

Boosting a property’s value doesn’t always require grandiose changes—sometimes, the most effective renovations are also the most cost-effective. Focusing on modern updates that align with neighborhood standards can make a property more attractive without the risk of over-renovating.

Minor kitchen remodels, for example, can have a substantial impact on a property’s appeal and market value.

Working with Contractors

Successfully renovating properties often requires collaborating with skilled contractors. Establishing clear expectations, understanding the costs, and planning for contingencies are all part of working effectively with contractors.

By building a strong partnership with the right team, investors can ensure that their renovation projects are completed efficiently and add significant value to their properties.

Advanced Real Estate Investment Strategies

For those looking to delve deeper into the world of real estate investing, there are advanced strategies that can open up new avenues for profit. These tactics, including wholesale real estate, predictive analytics, and collaborative investment groups, cater to investors who are ready to take their portfolio to the next level.

These sophisticated methods require a keen understanding of the market and a readiness to embrace more complex investment models.

Wholesale Real Estate Strategy

Wholesale real estate is a strategy that allows investors to generate income with minimal risk and without the need for significant capital. By securing properties under a wholesale real estate contract and then selling those contracts for a profit, wholesalers can capitalize on market opportunities quickly and efficiently.

BatchLeads offer superior quality property data and suite of tools to enable your wholesaling real estate journey. Check out the video to know more.

This approach requires a good grasp of the market and the ability to find distressed properties ripe for investment.

Collaborative Investment Groups

Collaborative investment groups offer a platform for investors to pool their resources and knowledge, amplifying their investment power and diversifying their portfolio. By participating in these groups, investors can share the risks and rewards of real estate investments, accessing opportunities that may otherwise be beyond their individual reach.

This strategy can be particularly beneficial for those looking to scale their investments and explore new markets collectively.

Marketing Your Real Estate Investments

The success of a real estate investment isn’t just about choosing the right properties and financing options; it’s also about effectively marketing those investments. In today’s digital age, a robust marketing strategy that includes online presence, open houses, networking, and lead generation is essential.

Understanding how to showcase your properties and connect with potential buyers can significantly impact the speed and profitability of your real estate transactions. Working with real estate professionals, such as a real estate agent, can help you navigate this process more effectively and generate valuable seller leads

Open Houses and Networking

Open houses serve as a showcase for properties and provide an opportunity for investors to:

- Engage directly with potential buyers

- Network with other professionals in the industry

- Generate leads for future business opportunities

- Gain insights into the local market

These events can be a goldmine for investors looking to grow their business and stay informed about the real estate market, especially when partnering with lead generation companies to obtain real estate leads, as many real estate professionals do.

Sponsoring or participating in real estate events also enhances an investor’s visibility and can lead to valuable connections within the industry.

Establishing an Online Presence

In the digital era, an online presence is vital for real estate investors. A well-designed, mobile-optimized website can serve as the hub for all marketing efforts, providing immediate access to updated listings and attracting new prospective clients.

Encouraging clients to leave positive reviews can also boost credibility, draw in potential buyers, and generate quality leads.

Long-Term Real Estate Investment Planning

Long-term planning is the keystone of successful real estate investing. It involves:

- Strategic acquisition and management of properties

- Considering the endgame, whether it’s creating a steady stream of rental income, building equity, or planning for retirement

- Having a clear vision and exit strategy in the ever-changing landscape of real estate.

The Role of Due Diligence

Due diligence is a non-negotiable aspect of long-term real estate investment planning. It requires thorough research and analysis to make informed decisions that align with investment goals. This process helps investors avoid unforeseen pitfalls and ensures that each property contributes positively to the overall investment strategy.

Building a Scalable Investment Model

A scalable investment model is essential for investors looking to grow their real estate portfolios over time. By leveraging equity, utilizing vehicles like 1031 exchanges, and engaging in cash-out refinancing, investors can methodically expand their holdings. This approach allows for strategic growth and the ability to capitalize on emerging opportunities in the market.

Exit Strategies for Investors

An exit strategy is a critical component of any long-term investment plan. For real estate investors, this could mean holding onto properties for a consistent rental income or planning for a sale at the peak of market value. Selecting the right exit strategy depends on the investor’s goals, market conditions, and the performance of the investment properties.

Summary

In summary, real estate investing in 2024 remains a promising avenue for those seeking to build wealth. From exploring various property types to implementing advanced investment strategies and marketing tactics, the journey to maximizing returns is multifaceted. The insights shared here serve as a roadmap for both novice and experienced investors, empowering them to make informed decisions, adapt to market changes, and achieve long-term success.

Frequently Asked Questions

What are some key strategies for building a successful real estate portfolio?

Diversify across property types and locations, effectively allocate assets, manage investment risks through due diligence, and capitalize on growth opportunities driven by market trends and economic policies to build a successful real estate portfolio.

How can real estate investors finance their property investments in 2024?

Real estate investors can finance their property investments through options like bank loans, hard money loans, private money loans, home equity loans, crowdfunding, REITs, and collaborative investment groups, each with its own benefits and considerations. Consider the interest rates and repayment terms when choosing the best option for your investment.

What renovations offer the best return on investment for real estate properties?

To maximize return on investment for real estate properties, consider cost-effective renovations like minor kitchen remodels, exterior upgrades such as garage door replacement or stone veneer, and modernizing HVAC systems as these enhancements can elevate the property’s value and appeal.

What advanced real estate investment strategies can experienced investors use?

Experienced investors can consider wholesale real estate strategies, predictive analytics for market trends, collaborative investment groups, tax liens and deeds, and commercial property investments to advance their real estate investment portfolio. These strategies can offer new opportunities and potentially higher returns.

What factors should investors consider when planning their long-term real estate investment strategies?

When planning long-term real estate investment strategies, investors should consider comprehensive due diligence, a scalable investment model for growth, and a clear exit strategy that aligns with their financial goals and market conditions. This will help them make informed and profitable investment decisions.