If you’re diving into the world of wholesaling real estate, mastering assignment contracts is crucial. These contracts are the linchpin for wholesalers looking to facilitate property deals without purchasing the property themselves. Assignment contracts allow the transfer of purchasing rights to another buyer, offering the potential for profit with little upfront capital. In this article, we strip away the complexities surrounding these contracts and lay out a step-by-step guide to using them effectively. We’ll cover everything from the basic structure and legal compliance to overcoming common obstacles and marketing your deals.

Key Takeaways

- Assignment contracts are a low-risk real estate investment strategy allowing wholesalers to earn a fee by transferring their right to purchase a property to a cash buyer.

- Effective assignment contracts must include clear definitions of the parties involved, precise property descriptions, and detailed financial terms to ensure legality and prevent disputes.

- Wholesalers must navigate legal compliance, establish clear contingencies, and build relationships with both motivated sellers and cash buyers to successfully wholesale properties through assignment contracts.

Exploring the Basics of Real Estate Assignment Contracts

Picture this: you’ve discovered a property ripe for investment but lack the funds to make the real estate purchase. Enter the real estate assignment contract—a legal document that becomes your golden ticket in such scenarios. As a property owner, a wholesaler can flip a contract to a cash buyer and pocket a fee in the process by securing the exclusive right to buy a property. It’s like holding a reservation you can sell at a premium to someone eager to take your place.

This method allows for wholesale real estate investing with minimal financial risk and positions you as a key intermediary. You’re the maestro, orchestrating a deal between the hopeful seller and the ready real estate investor, all the while keeping your eyes on the prize (an assignment fee) that reflects your ability to spot and secure a promising lead.

The Structure of an Effective Assignment Contract

An assignment contract is more than just a handshake and a promise; it’s a meticulously crafted document that sets the stage for a successful and legally sound real estate transaction. At its core, it should clearly define:

- The rights and obligations being transferred

- The financial terms

- A detailed description of the property

- All bound by the consent of the parties involved

The purchase agreements serve as the deal’s blueprint, promoting clarity and confirming that all parties agree before proceeding.

Creating an Assignment Contract

When creating an assignment contract, it’s best to work with an attorney who’s well versed in the laws and regulations around real estate wholesaling in your state. Wholesalers who try to cut this corner by using a contract they found online can experience problems later if it’s a poorly written contract or one that’s written for a market with different regulations.

In order to create an assignment contract, you must first find quality leads and then get in touch with the homeowner to agree on terms offered and sign the deal. The purchase deal, also referred to as a wholesaling contract, states that the wholesaler has the right to buy the property.

When the wholesaler secures an cash buyer who is interested in buying the property, the two parties enter into a real estate assignment contract. This contract transfers all obligations from the wholesaler to the buyer. The same terms outlined in the purchase deal carry over to the buyer except for the price of the property.

The key elements of an assignment contract are:

- A copy of the original wholesale contract or purchase deal

- The legal names of the buyer and seller

- The property’s street address, type of property, and assessor’s parcel number (APN)

- The physical condition of the property, including any defects and repairs

- The purchase price as well as specifications regarding financing and deposits (if applicable)

- The closing date

- Any contingencies

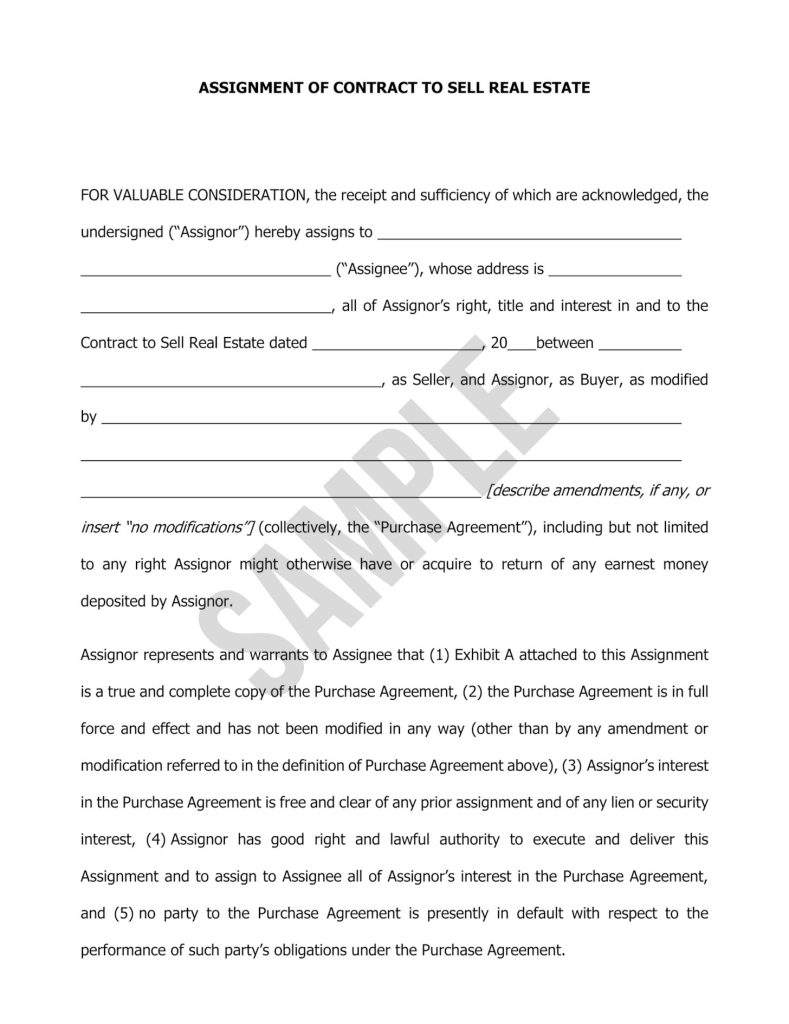

Here is a basic example of an assignment contract agreement, which will help guide you understand better as you read through.

Identifying the Contract Parties

When it comes to assignment contracts, it’s a trio performance featuring the assignor (you, the wholesaler), the assignee (the end buyer), and the original seller. As the wholesaler, you’re the pivotal figure, holding the rights to purchase which you intend to pass on to the assignee. The end buyer, or assignee, steps into your shoes, adopting all the benefits and responsibilities of the original purchase agreement. And let’s not forget the original seller , who kicked off this chain by agreeing to sell the property.

Describing the Subject Property

A blurry property description can turn a promising deal into a legal quagmire. That’s why the contract must paint a clear picture of the property in question, with no detail left to the imagination. A precise legal description lays the foundation for a binding contract, one that leaves no room for disputes about what’s being bought and sold.

Every detail, from lot measurements to included fixtures, adds to the property’s value and enhances the appeal of the deal. Overlooking the specifics of what stays and what goes can lead to misunderstandings and, worse, devalue the very asset you’re aiming to profit from.

Determining the Financial Terms

Money talks, and in real estate, it speaks volumes. The assignment contract must clearly spell out the financial obligations of the parties involved, starting with the earnest money deposit—a show of good faith from the assignee that guards you against a change of heart. Then there’s the assignment fee, which can fluctuate based on the property’s appeal and the buyer’s willingness, but expect to negotiate around the $5,000 mark as a benchmark.

Legality and Compliance in Assignment Contracts

Diving into the legal depths of assignment contracts, one must navigate the waters of legality and compliance with a keen eye. A contract is only as strong as its adherence to the law and clarity in its terms. The parties involved must be competent, not just in making decisions but also in the eyes of the law—of age and of sound mind. The contract must stand up to legal scrutiny, aligning with local laws and avoiding the murky areas of illegal activities or unconscionable demands.

Securing the services of a real estate attorney as earlier mentioned and in some states a real estate agent with a real estate license is a crucial step. They are the seasoned guides who can steer you through the complexities of real estate contracts and ensure that your agreement meets all necessary legal standards, from the statute of frauds to the finer points of state and local regulations.

Executing a Real Estate Assignment Contract

The execution of an assignment contract signals the culmination of all your groundwork, where the documents are signed, and the promises made on paper transmute into concrete actions. This critical juncture is not just about making it official; it’s also about ensuring that your interests as a wholesaler are buttoned up, protecting you once you’ve handed off the baton to the end buyer.

Preparing for Closing

The closing is the grand finale, and preparing for it means leaving no stone unturned. The closing date should be circled in red, signaling the day when the property changes hands and the profits are realized. However, the buyer’s ability to close the deal is the bedrock upon which your assignment contract rests.

Contingencies are your safety net, allowing you to bow out gracefully should the deal hit a snag before the closing date. And let’s not forget closing costs – knowing who bears the brunt of these fees can influence the deal’s structure and the smoothness of the final act.

Overcoming Obstacles in Assignment Contract Wholesaling

The path to successful wholesaling is often uneven; it’s filled with obstacles that can challenge even the most experienced wholesalers. From restrictive contracts that forbid assignment to financial contingencies that can snarl up transactions, these hurdles require strategic maneuvering and a keen understanding of the wholesaling landscape.

Dealing with Non-Assignable Contracts

Encountering a non-assignable contract requires innovative thinking. Some contracts leave no room for direct assignment, but that doesn’t mean you’re at a dead-end. You can resort to using a Standard Contract Assignment Addendum to circumvent restrictions or, when all else fails, execute a double closing, briefly taking title before passing it along to the end buyer.

Summary

Mastering wholesaling through assignment contracts involves:

- Navigating a path that requires minimal initial capital but offers numerous profit opportunities

- Connecting motivated sellers with cash buyers

- Crafting contracts that are as bulletproof as they are profitable

- Overcoming challenges with grit and ingenuity

It’s a journey that can be highly rewarding for those who are willing to put in the effort.

Wholesaling real estate is an entry point into the property market, but it’s also a test of one’s ability to understand and adapt to the real estate landscape, where continuous learning is non-negotiable.

Check out our Free training on Real Estate Investing to know more.

Frequently Asked Questions

What exactly is a real estate assignment contract?

A real estate assignment contract is a legal agreement that allows an investor to transfer their rights and obligations under a property purchase agreement to another party, typically for a fee, often used in wholesaling to earn a profit without purchasing the property outright.

How does a wholesaler make money with an assignment contract?

A wholesaler makes money by negotiating a purchase price with a seller and then assigning the contract to an end buyer for a higher price, pocketing the difference as their profit, also known as the assignment fee.

Do I need a real estate license to wholesale properties using assignment contracts?

No, you generally do not need a real estate license to wholesale properties using assignment contracts, but it’s important to understand local regulations and work with a real estate attorney for legal compliance.

Can all real estate contracts be assigned to another party?

No, not all real estate contracts are assignable as it depends on the contract terms, some contracts may have clauses that forbid assignment or require seller’s consent. Make sure to review the terms or use a standard contract assignment addendum if needed.

What are some common obstacles in wholesaling with assignment contracts?

Some common obstacles in wholesaling with assignment contracts are non-assignable contracts, financing contingency hurdles, legal competence of parties, and navigating state and local laws. Solutions may involve double closings, contract addendums, and seeking legal advice.