Investing in tax delinquent properties can be a lucrative opportunity for savvy real estate investors. These properties, which become available when owners fail to pay their property taxes, can be purchased at a significant discount. This guide will cover the basics of tax delinquent properties, how investors can find them, and the pros and cons of investing in such properties.

What Are Tax Delinquent Properties?

A tax delinquent property is real estate where the owner has failed to pay state or local property taxes. After a certain period of time, this non payment causes the property to become tax delinquent and the government starts a series of legal and administrative actions to collect the taxes owed. In essence, the property becomes a financial burden to the local government because the owner can’t or won’t pay their property tax bill.

Legal and Administrative Actions

When property taxes remain unpaid, the government places a legal claim, known as a property tax lien, against the property. This lien represents the debt owed to the government. If the taxes continue to remain unpaid, the government may proceed with a tax sale to recover the owed amount. There are generally two types of tax sales:

1. Tax Lien Sales: The government sells the lien to an investor. The investor then has the right to collect the owed amount, plus interest, from the property owner.

2. Tax Deed Sales: The government sells the actual property to recover the unpaid taxes. In this case, the buyer acquires the property itself, often at a discounted price.

How Investors Can Find Tax Delinquent Properties

Finding tax delinquent properties requires some research and diligence. Here are several methods to locate these investment opportunities:

Public Records

Local government offices, such as the county tax assessor or treasurer’s office, maintain records of tax delinquent properties. These records are typically public and can be accessed either in person or online. Reviewing these records will provide information on properties with outstanding tax liabilities.

Tax Sale Auctions

Local governments often hold tax sale auctions, where tax delinquent properties are sold to the highest bidder. These auctions can be held in person or online. Investors can find information about upcoming tax sales on county websites or by contacting the county tax office.

Real Estate Investment Software

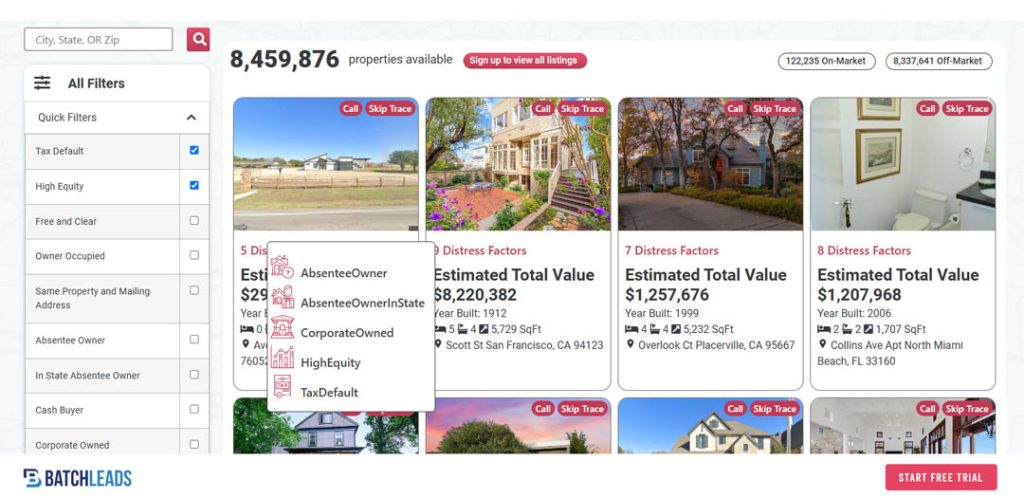

A more simple and effect approach is to leverage REI Software like BatchLeads where you can get access to accurate nation wide property home owner data with more than 300 data points per property record which includes Tax Delinquent Properties, Tax Default, High Equity and a lot more distress factors to help you pin point a potential deal.

Get access to Tax Delinquent Properties near you with our 7 Day Risk Free Trial

Networking

Connecting with local real estate agents, investors, and real estate investment groups can provide valuable leads on tax delinquent properties. Networking with these professionals can also offer insights into the local real estate market and the tax sale process.

Pros of Investing in Tax Delinquent Properties

Discounted Purchase Price

One of the most significant advantages of investing in tax delinquent properties is the potential for a discounted purchase price. Since these properties are often sold to recover unpaid taxes, they can be acquired for a fraction of their market value.

High Return on Investment

Investors can achieve a high return on investment (ROI) by purchasing tax delinquent properties at a discount and then reselling them at market value or renting them out. The profit margin can be substantial, especially if the property is located in a desirable area.

Diverse Investment Opportunities

Tax delinquent properties can include a variety of property types, such as single-family homes, multi-family units, commercial properties, and vacant land. This diversity allows investors to choose properties that align with their investment strategy and risk tolerance.

Helping Communities

By purchasing tax delinquent properties, investors help local governments recover owed taxes, which can be used to fund essential public services. Additionally, rehabilitating and improving these properties can enhance the overall quality of the neighborhood.

Risks of Investing in Tax Delinquent Properties

Property Condition

Tax delinquent properties may be in poor condition due to neglect by the previous owners. Investors should be prepared for potential renovation and repair costs, which can add to the overall investment.

Calculating the ARV (After Repair Value) will provide you with an estimated repair cost and the expected ROI from the deal.

Title Issues

There can be complications with the property’s title, such as undisclosed liens or legal disputes. Investors should conduct thorough due diligence, including a title search, to ensure there are no hidden issues that could affect their investment.

Competition

Tax sale auctions can be competitive, with multiple investors vying for the same properties. This competition can drive up the purchase price, reducing the potential profit margin.

Legal and Administrative Complexity

The process of purchasing tax delinquent properties can be complex and varies by state. Investors need to familiarize themselves with the specific laws and procedures governing tax sales in their target area. This may involve understanding redemption periods, bidding processes, and legal requirements. But once the property is foreclosed the ownership transfer can be completed.

Additional Read [PDF] : A White Paper on Property Tax Delinquency in the United States with a deep dive into three states Ohio, Michigan, Massachusetts by Jenna DeAngelo, Lincoln Institute of Land Policy

Summary: Investing in Tax Delinquent Properties

Investing in tax delinquent properties is a chance to buy real estate at a discount and profit from the high returns. Although not without risk or challenge, like property condition and legal issues, tax delinquent properties pose one of the highest potential profit margins out of all real estate investment strategies.

For investors who are willing to do their research and due diligence, these properties can be a great addition to their real estate portfolio. By understanding the basics, using the resources to find properties and weighing the pros and cons, investors can make informed decisions and cash in on these hidden real estate gems.