After a challenging year in the real estate market, we decided to check the pulse of real estate investors, wholesalers, and agents. We collected feedback from nearly 400 survey respondents to gain insight into their experiences and understand how real estate professionals are adapting to current market conditions. Even with the headlines declaring that it’s best to hold off on real estate investing for the time being, we found that respondents are optimistic about their futures in real estate investing.

Here are six key questions from the survey and the insights which investors can use to understand the state of the market and how others are navigating a challenging housing market.

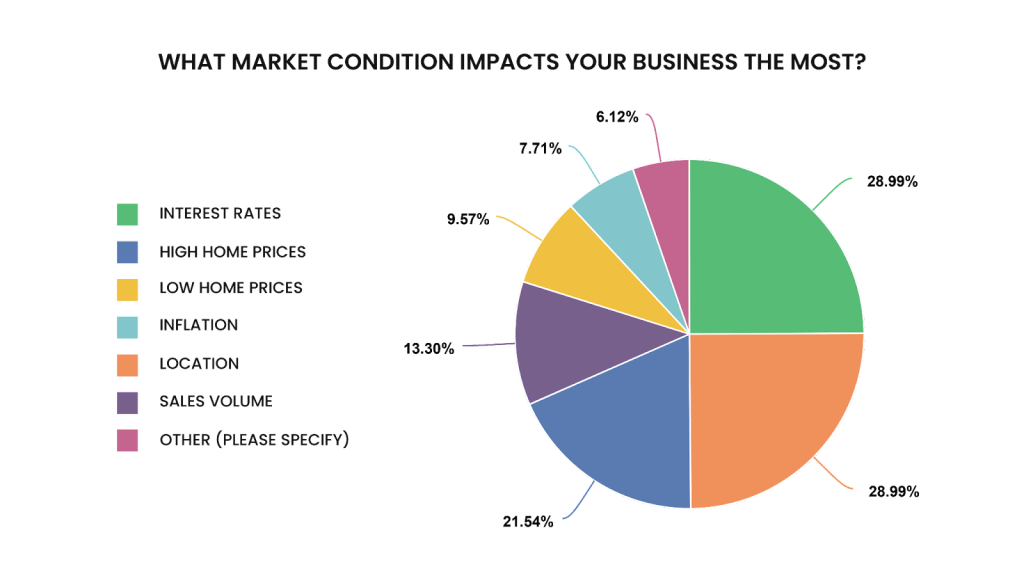

What market condition impacts your business the most?

Investors are reporting that their two strongest challenges are high interest rates and high home prices. About 29% of survey respondents cited high interest rates as having the largest impact on their business, while 21% cited high home prices.

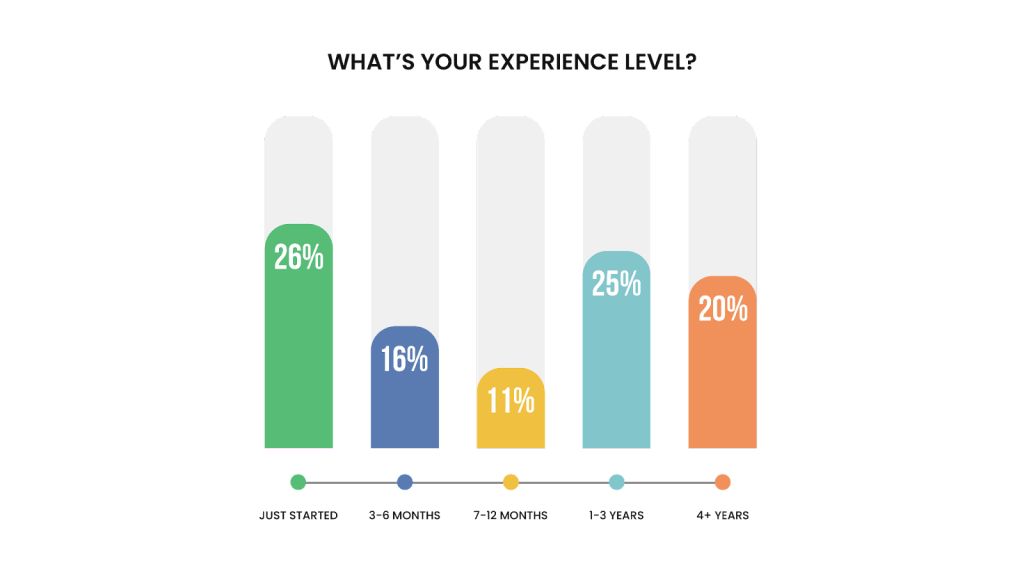

What’s your experience level?

The majority of respondents are new to real estate, with 54% of respondents reporting that they’ve been in real estate for twelve or fewer months. Despite higher interest rates and stubbornly high home prices across the country, real estate remains an attractive investment opportunity and continues to draw new investors.

What’s your outlook on the real estate market?

Even with the current challenges real estate investors are facing, their outlook on the real estate market is optimistic. Approximately 40% of respondents described their outlook as “positive,” while 35% described their outlook as “very positive.” When asked how they expected their business to perform in the coming year, about 78% said they expected their business to perform “better.” Eighteen percent said they expect it to perform “about the same,” and only about 3% of respondents said they expected their business to perform “worse.”

How big is your organization?

The majority of respondents are keeping overhead and expenses low by running a lean operation. About 49% of respondents said they’re a one-person operation, while approximately 47% said that their business consists of ten or fewer people.

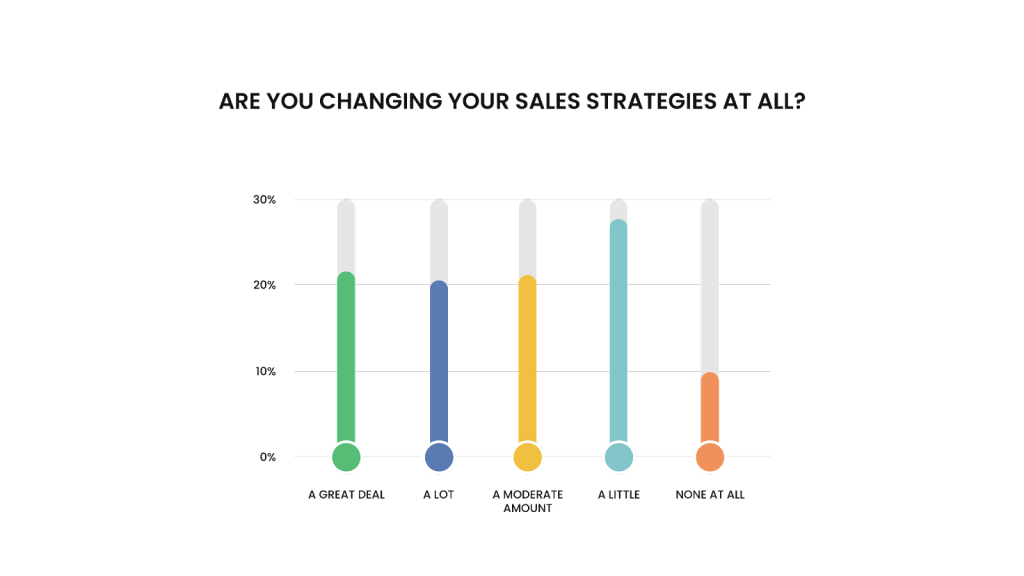

Are you changing your sales strategies at all?

Change is in the air: about 90% of respondents said that they are changing their sales strategies. Amongst the group, the extent to which they’re changing their strategy varies, as the graphic below shows.

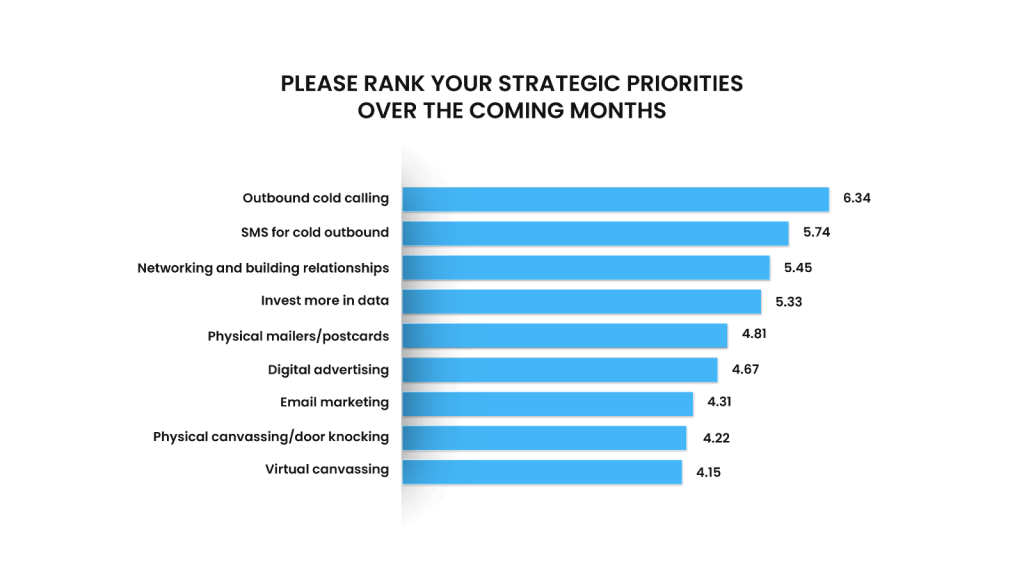

6.What are your strategic priorities over the coming months?

When asked about their strategies for the coming months, outbound cold calling narrowly emerged as the most important priority for a slim majority of respondents. The three most popular strategies after cold calling were SMS for cold outbound, networking and building relationships, and investing more in data.

Key Takeaways

A surprise in our findings was the sense of optimism shared by the majority of respondents, which sits in contrast to current groupthink. This disparity could be due to the type of investing respondents engage in: about 58% of respondents stated that their business focuses on real estate wholesaling. Because wholesalers seek out distressed properties, they’re less impacted by runaway home prices than buyers who are seeking newer, less distressed properties.

Another cause for optimism could be because respondents have a greater ability to weather economic headwinds thanks to their low operating costs. As we noted above, about 49% of respondents are solopreneurs, while about 47% of operations consist of ten or fewer people. These respondents are less likely to be burdened by high operating costs that make this cooling period a greater pain point for investors with large overhead expenses.

While the current line of thinking in the industry is that no one is buying real estate, that is clearly an exaggeration. Although the volume of home sales has dipped nationwide, investors are still buying properties because real estate is an enduring and robust asset class. The average house price in the United States has increased in value at 4.4% per year since 1991. While the cost of borrowing remains an obstacle, it’s still difficult to beat that level of consistent appreciation.