Selling a home can be overwhelming, often involving numerous steps and significant expenses. While many homeowners choose to work with real estate agents to simplify the process, some opt for a different approach: For Sale By Owner (FSBO). This method allows sellers to take full control of the sale, potentially saving thousands in commission fees. However, this is a great opportunity for a potential investor or a wholesaler to leverage. In this article, we’ll delve into what FSBO entails, its benefits and drawbacks, and tips for those considering this path to profitable deals.

Key Takeaways

- FSBO (For Sale By Owner) allows homeowners to sell their property without a real estate agent, taking control of marketing, negotiations, and finalizing the sale.

- The primary benefits of FSBO sales include savings on commission fees, which can be significant, and having complete control over the entire selling process.

- FSBOs have huge potential for profits if one is able to locate and negotiate with the right pricing. Factoring in the costs involved will still make it a desirable strategy for investors and wholesalers.

What does FSBO Mean?

The term FSBO stands for ‘For Sale By Owner,’ a method of selling property where the homeowner opts to take on all aspects of the sale without a real estate agent to serve as the intermediary. This choice means the homeowner becomes responsible for all aspects of the FSBO transaction, including setting the right price, staging the home, and dealing with legal paperwork.

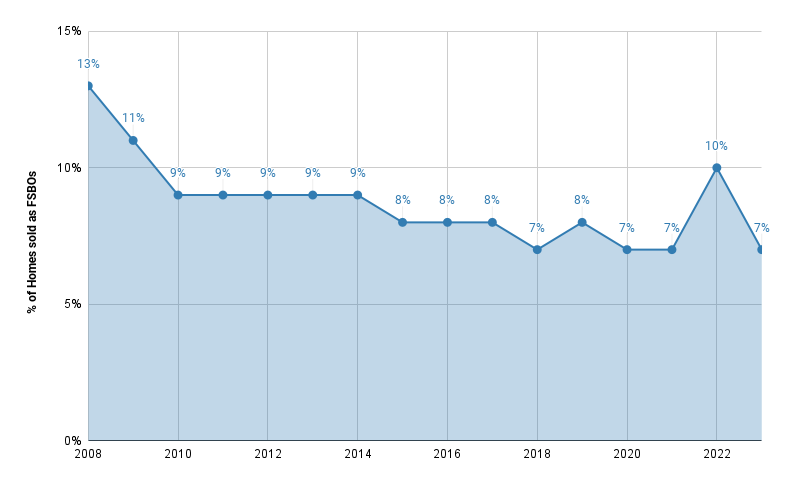

Looking at the graph below, 7%-13% of all homes sold annually since 2008 were FSBOs. About 4.09M homes were sold in 2023, meaning agents lost out on around 286,300 potential deals if they had access to the right property data and home owner info.

What are the benefits of finding FSBO listings?

FSBO (For Sale By Owner) listings can offer significant advantages to both Real Estate Investors and Real Estate Wholesalers with the right mix of motivation and equity.

1. Lower Acquisition Costs: By eliminating real estate agents from the equation, wholesalers or investors can often negotiate lower purchase prices, thereby increasing their profit margins when they assign or flip the contract.

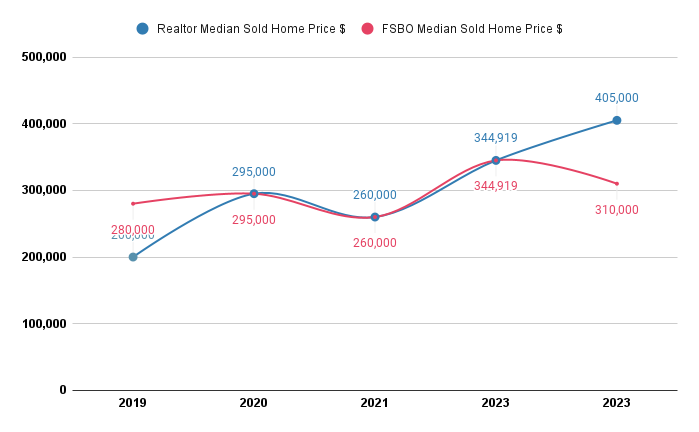

Take a look at the median sold home pricing difference between Realtor vs FSBO since 2019. FSBOs with almost 24% less median sale price compared to a realtor listing.

// Early access FSBO Properties near you with our 7 Day Risk Free Trial with 500 Free FSBO Leads. //

2. Direct Access to Sellers: Real Estate Investors & Wholesalers can directly engage with homeowners who may be eager to sell quickly (Motivated Sellers) or have unique circumstances. This direct connection can present opportunities for acquiring discounted deals or distressed properties.

3. Flexibility in Negotiation: FSBO transactions often involve sellers who are more open to creative financing or flexible terms, allowing wholesalers to structure deals that meet their investment criteria more effectively.

4. Streamlined Transaction Process: With fewer intermediaries, FSBO deals can close faster, enabling wholesalers / investors to move inventory quickly and efficiently.

5. Access to Off-Market Opportunities: Many FSBO properties are not listed on traditional platforms like MLS, giving wholesalers access to off-market deals that may have less competition and greater profit potential.

6. Potential for Building Relationships: Direct engagement with FSBO sellers can lead to ongoing relationships and referrals, expanding a investors network and deal flow over time.

In summary, FSBO listings provide wholesalers and investors with opportunities to acquire properties at favorable prices, streamline transactions, and access off-market deals, all of which are crucial for maximizing profits in real estate wholesaling.

What are the costs involved in an FSBO deal for an investor?

For real estate investors engaging in FSBO (For Sale By Owner) deals, the costs involved can vary based on the specific circumstances and strategies employed. Here are some common costs to consider:

1. Acquisition Costs: While FSBO deals can sometimes offer lower acquisition costs due to the absence of agent commissions, investors must ensure they are acquiring the property at a price that aligns with their investment goals and market value.

2. Due Diligence Expenses: It is crucial to perform comprehensive due diligence before finalizing an FSBO deal. This process may involve hiring a home inspector to evaluate the property’s condition, conducting a title search to ensure there are no liens or legal issues, and potentially obtaining a property appraisal to accurately determine its market value.

3. Legal and Administrative Costs: Budget needs to be allocated for legal fees associated with drafting or reviewing contracts, preparing necessary documents (such as purchase agreements and disclosures), and potentially hiring a real estate attorney to navigate any legal complexities specific to the transaction.

4. Repair and Renovation Costs: Depending on the property’s condition, there should be provision for repairs or renovations to bring the property up to market standards or increase its value. This could include cosmetic updates, structural repairs, or improvements to attract tenants or future buyers. Calculating the After Repair Value (ARV) is a great way to negotiate with sellers as it gives a fair idea regarding the property’s worth after renovations especially in the case properties with various distress factors.

5. Closing Costs: Similar to traditional real estate transactions, investors typically cover closing costs such as title insurance, recording fees, transfer taxes, and any prorated property taxes or homeowners association dues. These costs ensure the legal transfer of ownership and protect the investor’s interests.

6. Financing Costs: If investors are financing the purchase through a mortgage or other lending sources, they’ll need to consider costs such as loan origination fees, appraisal fees required by lenders, and interest payments over the loan term.

7. Marketing and Holding Costs: Depending on the investor’s strategy, additional costs may include marketing expenses to attract tenants or buyers (if flipping), property management fees (if renting out), and ongoing maintenance or utility expenses during the holding period.

How to find FSBO listings near you?

Limited market exposure for FSBOs makes it really tough to find quality leads especially if they are off market and not listed in MLS. Here are a few proven methods where one can get closer to FSBO listings.

- Online tools that include FSBO properties: One of the simplest methods is to leverage a real estate platform that allows you to search for FSBO-specific listings, such as BatchLeads. These tools are particularly useful as they often combine property details with homeowner contact information to easily search, prioritize, and reach FSBO property owners.

Check out our 7 Day Risk Free Trial with 500 Free FSBO Leads.

- Online Classifieds : Websites like Craigslist, Facebook Marketplace are popular platforms where homeowners list their properties for sale.

- Local Newspapers and Community Bulletins: Many homeowners still use traditional methods to advertise their FSBO properties. Check the classified sections of your local newspapers and community bulletin boards for listings.

- Driving for Dollars: This old-school method involves driving through neighborhoods to spot “For Sale By Owner” signs. This hands-on approach can help you find properties that may not be listed online.

- Networking: Building a network of real estate professionals, investors, and even other homeowners can provide leads on FSBO properties. Attend local real estate meetups and events to expand your network.

- Direct Mail Campaigns: Sending postcards or letters to homeowners expressing your interest in purchasing their property can generate leads. Target areas where you know there are FSBO properties or where homeowners might be considering selling.

- Real Estate Auctions and Estate Sales: Keep an eye on real estate auctions and estate sales, as these events can sometimes feature FSBO properties.

- Public Records and Property Listings: Accessing public records can provide information on properties that have been recently sold or are in pre-foreclosure. These records can be a goldmine for finding FSBO opportunities.

By utilizing a combination of these strategies, you can increase your chances of finding FSBO listings and capitalize on the unique opportunities they present. Remember, persistence and consistency are key when searching for FSBO properties.

Summary

FSBO offers a compelling alternative to traditional real estate transactions, allowing sellers to take control and potentially save thousands in commissions at the same being an open ended opportunity for an investor or a wholesaler with the right skillset to pull off a profitable deal. Thorough planning, due diligence, and budgeting are essential for successful FSBO transactions.