For newer real estate investors, the term “disposition” of real estate may sound like a high-level concept, but it actually has a simple meaning. Disposition of real estate simply refers to the sale or process of selling property or the sale or process of selling one’s interest in a property. For real estate investors, disposition is an important part of the investing process.

Reasons for Disposition

When we discuss real estate, the acquisition or buying process tends to get more focus. The disposition process is rarely discussed even though it’s how investors make their money. Here are some common reasons why investors start the real estate disposition process.

Increase Cash Flow

Some real estate investors may enter the disposition process because they’re ready to exit the industry and want to take their money with them. For other investors, they may need to free up cash for a better investment opportunity.

Exiting Before More Loss

Sometimes, real estate investors have to weather financial losses despite doing everything right on their end. A rental property fails to attract tenants; a new zoning regulation makes a commercial property less viable. Even an asset as stable as real estate can be subject to market declines or other situations that can cause an investment to lose money. If a property is only making a small profit or consistently losing money, investors will commonly enter the disposition process to stop their financial losses.

Portfolio Diversification

The more diversified an investor’s portfolio is, the better they’ll be able to weather a drop in value of one of their assets. Within a real estate portfolio, it’s a good idea to diversify the types of investment properties.

If, for example, the commercial real estate market takes a hit, having rental properties can offset the impact of a commercial asset declining in value. If an investor has too much of a certain type of real estate, the disposition of one property can be used to add a new property or properties to increase portfolio diversity.

End of Holding Period

Experienced real estate investors often make an investment with a clear idea of when they’ll exit the property. It could be after their investment yields a certain amount, or they’ve chosen a disposition timeline in accordance with their other investments. If it’s a property that has been purchased with other investors, the timing of the disposition of real estate is often determined at the beginning of the investment process.

Strategies for Disposition

Traditional Sale

A traditional sale is by far the most common method of real estate disposition. In this type of disposition, the seller decides upon a price based on comps, markets the property, and then accepts an offer. This is typically followed by an inspection of the property, then an appraisal.

If the purchaser is not a cash buyer, they’ll likely need to finance the purchase, but the transaction will close after that step on the buyer’s end. If the inspection reveals significant disrepair of the property, the seller and the buyer can renegotiate based on the cost of the repairs.

1031 Exchange

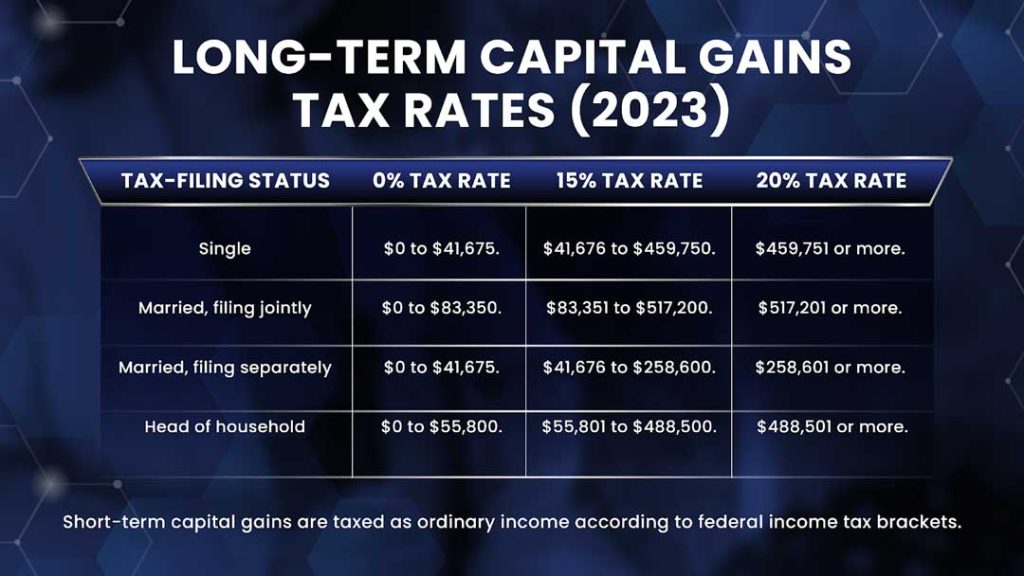

One thing to be mindful of in the disposition of real estate is that the profits from the sale of any asset can be subject to a capital gains tax. Assets that are held for less than one year are subject to a short-term capital gains tax. In this scenario, short-term capital gains are reported as income and taxed at the same rate as the rest of your income. Long-term capital gains taxes are applied to assets that are held for one year or longer.

There is a way that investors can legally sidestep this tax liability. There’s something called a 1031 exchange, which enables investors to defer the capital gains tax as long as they buy another property within 180 days of the disposition of the first property.

The 1031 exchange laws specify that the asset purchased must be of like kind to the asset that has been sold, but that can include any type of land or property. If some of the sale proceeds are not used to buy a new property, they can be subject to a capital gains tax.

Conclusion

While there are numerous factors that come into play when determining disposition timing, it’s an important concept to master, because it’s when an investor makes their money back. There are a few steps investors can take to make the disposition process go smoothly: establish an exit strategy prior to acquisition, build a network of cash buyers, and create a game plan for the proceeds from the sale.